Expansion of Environmental Monitoring

The expansion of environmental monitoring efforts significantly influences the Geographic Information System Gis Software Market. With growing concerns about climate change and environmental degradation, organizations are increasingly utilizing GIS software to monitor natural resources, track pollution levels, and assess the impact of human activities on ecosystems. Data indicates that the environmental monitoring sector is experiencing rapid growth, with investments in GIS technology expected to rise. This software enables precise mapping and analysis of environmental data, facilitating informed decision-making for conservation efforts. As regulatory frameworks become more stringent, the demand for GIS solutions that support compliance and reporting is likely to increase, further driving the Geographic Information System Gis Software Market.

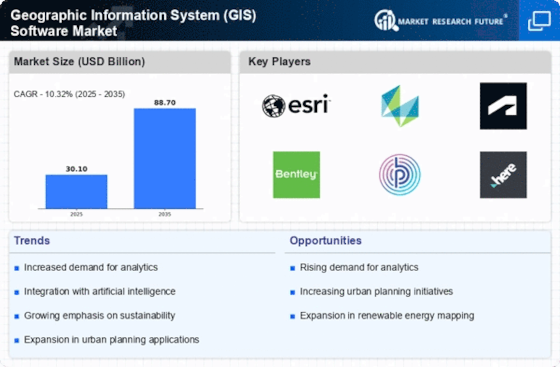

Advancements in Spatial Data Analytics

Advancements in spatial data analytics are reshaping the Geographic Information System Gis Software Market. The integration of sophisticated analytical tools within GIS software allows users to derive actionable insights from complex datasets. This capability is particularly valuable in sectors such as transportation, agriculture, and public health, where spatial analysis can lead to improved outcomes. Market data suggests that the demand for advanced analytics features is on the rise, as organizations seek to enhance operational efficiency and strategic planning. By harnessing the power of spatial data, businesses can optimize resource allocation, improve service delivery, and make data-driven decisions. This trend underscores the importance of innovative GIS solutions in the evolving landscape of the Geographic Information System Gis Software Market.

Growing Need for Location-Based Services

The growing need for location-based services is a critical driver for the Geographic Information System Gis Software Market. As businesses and consumers increasingly rely on location data for various applications, the demand for GIS software that can provide accurate and timely information is surging. Industries such as retail, logistics, and tourism are leveraging location-based services to enhance customer experiences and streamline operations. Market analysis indicates that the location-based services sector is expanding rapidly, with significant investments being made in GIS technologies. This trend is likely to continue as organizations recognize the value of location intelligence in gaining competitive advantages. Consequently, the Geographic Information System Gis Software Market is poised for substantial growth as it caters to this burgeoning demand.

Integration of IoT with GIS Technologies

The integration of Internet of Things (IoT) with GIS technologies is emerging as a transformative driver for the Geographic Information System Gis Software Market. As IoT devices proliferate, the ability to collect and analyze spatial data in real-time becomes increasingly feasible. This integration allows for enhanced monitoring and management of assets across various sectors, including agriculture, transportation, and urban planning. Data suggests that the convergence of IoT and GIS is expected to create new opportunities for innovation and efficiency. Organizations are likely to invest in GIS solutions that can seamlessly incorporate IoT data, enabling smarter decision-making and improved operational performance. This trend highlights the potential for growth within the Geographic Information System Gis Software Market as it adapts to the evolving technological landscape.

Increasing Adoption of Smart City Initiatives

The increasing adoption of smart city initiatives is a pivotal driver for the Geographic Information System Gis Software Market. As urban areas strive to enhance efficiency and sustainability, GIS software becomes essential for urban planning, resource management, and infrastructure development. According to recent data, investments in smart city projects are projected to reach substantial figures, indicating a robust demand for GIS solutions. These initiatives often require advanced spatial analysis and real-time data integration, which GIS software adeptly provides. Consequently, municipalities and governments are increasingly leveraging GIS technology to optimize services, improve public safety, and enhance citizen engagement. This trend not only propels the market forward but also fosters innovation within the Geographic Information System Gis Software Market.