- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

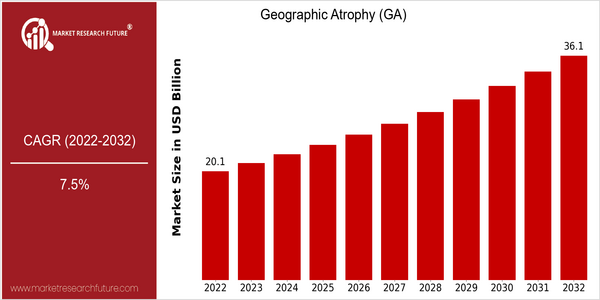

| Year | Value |

|---|---|

| 2022 | USD 20.07 Billion |

| 2032 | USD 36.1 Billion |

| CAGR (2024-2032) | 7.5 % |

Note – Market size depicts the revenue generated over the financial year

The Geographic Atrophy (GA) market is poised for significant growth, with the current market size estimated at USD 20.07 billion in 2022 and projected to reach USD 36.1 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 7.5% from 2024 to 2032. The increasing prevalence of age-related macular degeneration (AMD), coupled with an aging global population, is a primary driver of this market expansion. As the incidence of GA rises, there is a growing demand for innovative treatment options and diagnostic tools, which are essential for managing this debilitating condition effectively. Technological advancements in drug development, particularly in gene therapy and biologics, are also contributing to the market's growth. Companies such as Apellis Pharmaceuticals and Regeneron Pharmaceuticals are at the forefront of this innovation, with strategic initiatives that include partnerships and clinical trials aimed at bringing new therapies to market. For instance, Apellis' recent advancements in complement inhibition therapies have garnered significant attention, highlighting the potential for novel treatment modalities to reshape the landscape of GA management. As these trends continue to evolve, the GA market is expected to experience sustained growth, driven by both demographic factors and technological innovations.

Regional Market Size

Regional Deep Dive

The Geographic Atrophy (GA) Market is experiencing significant dynamics across various regions, driven by an aging population, increasing prevalence of age-related macular degeneration (AMD), and advancements in treatment options. In North America, the market is characterized by high healthcare expenditure and robust research initiatives, while Europe benefits from strong regulatory frameworks and collaborative research efforts. The Asia-Pacific region is witnessing rapid growth due to rising awareness and improving healthcare infrastructure, whereas the Middle East and Africa face challenges related to healthcare access and economic disparities. Latin America is gradually emerging as a market with increasing investment in healthcare and growing patient populations.

Europe

- The European Medicines Agency (EMA) has introduced new guidelines for the evaluation of therapies for GA, which may streamline the approval process and encourage more companies to enter the market.

- Collaborative research initiatives, such as those led by the European Vision Institute, are focusing on innovative treatment approaches, which could lead to breakthroughs in GA management.

Asia Pacific

- Countries like Japan and Australia are witnessing increased investment in ophthalmic research, with local companies developing novel therapies for GA, reflecting a growing focus on this condition.

- The rise of telemedicine in the region is improving patient access to specialists, which is crucial for early diagnosis and management of GA.

Latin America

- Brazil is seeing a surge in clinical trials for GA therapies, driven by both local and international pharmaceutical companies, which is expected to boost treatment options in the region.

- Government programs aimed at improving healthcare access are gradually increasing awareness and diagnosis rates of GA, which could lead to a larger patient population seeking treatment.

North America

- The U.S. Food and Drug Administration (FDA) has recently accelerated the approval process for innovative therapies targeting GA, which is expected to enhance treatment accessibility and market growth.

- Key players like Regeneron Pharmaceuticals and Novartis are investing heavily in clinical trials for new GA treatments, indicating a strong commitment to addressing this unmet medical need.

Middle East And Africa

- Healthcare initiatives in countries like South Africa are focusing on increasing awareness and screening for GA, which is essential for early intervention and treatment.

- The World Health Organization (WHO) is collaborating with local governments to enhance healthcare infrastructure, which may improve access to GA treatments in underserved areas.

Did You Know?

“Approximately 1.75 million people in the United States are affected by Geographic Atrophy, a form of advanced age-related macular degeneration, highlighting the significant public health challenge it poses.” — American Academy of Ophthalmology

Segmental Market Size

The Geographic Atrophy (GA) market segment is currently experiencing stable growth, driven by an increasing prevalence of age-related macular degeneration (AMD) and a rising aging population. Key factors propelling demand include the urgent need for effective treatment options and advancements in retinal imaging technologies that enhance early diagnosis. Regulatory support for innovative therapies, such as gene therapies and complement inhibitors, further stimulates market interest. Currently, the adoption stage for GA treatments is transitioning from pilot phases to scaled deployment, with companies like Apellis Pharmaceuticals and Iveric Bio leading the charge with their respective therapies, Syfovre and Zimura. Primary applications include clinical settings focused on managing AMD and research institutions exploring novel therapeutic approaches. Notable trends, such as the increasing emphasis on personalized medicine and the integration of telemedicine for patient monitoring, are catalyzing growth. Technologies like artificial intelligence in diagnostic imaging and novel drug delivery systems are shaping the evolution of this segment, enhancing treatment efficacy and patient outcomes.

Future Outlook

The Geographic Atrophy (GA) market is poised for significant growth from 2022 to 2032, with the market value projected to increase from $20.07 billion to $36.1 billion, reflecting a robust compound annual growth rate (CAGR) of 7.5%. This growth trajectory is underpinned by an aging global population, as GA predominantly affects older adults, and the increasing prevalence of age-related macular degeneration (AMD). As awareness of GA rises, coupled with advancements in diagnostic technologies, we anticipate a higher penetration rate of treatment options, potentially reaching 30% of diagnosed patients by 2032, up from approximately 15% in 2022. Key technological drivers, including the development of novel therapies such as gene therapies and anti-VEGF agents, are expected to reshape the treatment landscape. Additionally, regulatory support for expedited approval processes and increased investment in research and development will further catalyze market expansion. Emerging trends, such as the integration of telemedicine for patient monitoring and the use of artificial intelligence in diagnostics, will enhance patient access to care and improve treatment outcomes. As these factors converge, the GA market is set to evolve significantly, offering substantial opportunities for stakeholders across the healthcare spectrum.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 20.07 Billion |

| Growth Rate | 7.5% (2022-2030) |

Geographic Atrophy GA Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.