Advancements in Genomic Technologies

Technological innovations in genomic sequencing and analysis are significantly influencing the Genomic Urine Testing Market. The advent of next-generation sequencing (NGS) has made genomic testing more accessible and affordable, facilitating its integration into routine clinical practice. As of 2025, the market for NGS is projected to reach several billion dollars, reflecting its growing importance in diagnostics. These advancements enable healthcare providers to offer personalized treatment plans based on individual genetic profiles, thereby improving therapeutic efficacy and patient satisfaction. Consequently, the proliferation of advanced genomic technologies is expected to drive demand for urine-based genomic tests.

Growing Awareness of Genetic Testing

The rising awareness of genetic testing among consumers is a significant driver for the Genomic Urine Testing Market. Educational initiatives and advocacy campaigns have contributed to a better understanding of the benefits of genomic testing, including its role in personalized medicine and disease prevention. As individuals become more informed about their genetic health, the demand for non-invasive testing methods, such as urine tests, is expected to increase. Market Research Future indicates that consumer interest in genetic testing is at an all-time high, suggesting a robust potential for growth in the genomic urine testing market as awareness continues to expand.

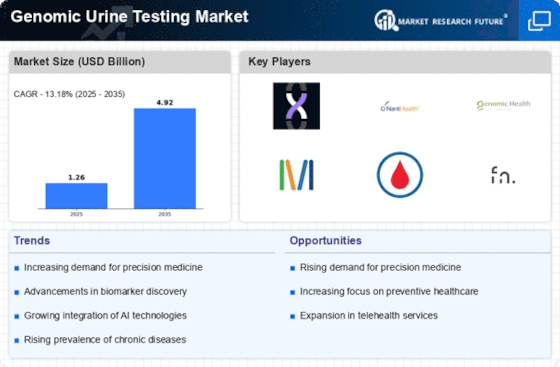

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a primary driver for the Genomic Urine Testing Market. As healthcare systems strive to manage these conditions more effectively, genomic urine testing offers a non-invasive method for early detection and monitoring. According to recent data, chronic diseases account for approximately 70% of all deaths, underscoring the urgent need for innovative diagnostic solutions. The ability of genomic urine tests to provide insights into disease predisposition and progression is likely to enhance patient outcomes and reduce healthcare costs, thereby propelling market growth.

Increased Focus on Preventive Healthcare

There is a notable shift towards preventive healthcare, which is becoming a crucial driver for the Genomic Urine Testing Market. As populations become more health-conscious, there is a growing emphasis on early detection and risk assessment of diseases. Genomic urine testing serves as a proactive approach, allowing individuals to understand their genetic predispositions and take preventive measures. Market data indicates that preventive healthcare spending is on the rise, with projections suggesting a substantial increase in investments in diagnostic tools. This trend is likely to foster a favorable environment for the adoption of genomic urine tests, as they align with the goals of preventive health strategies.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are pivotal in shaping the Genomic Urine Testing Market. Governments and health authorities are increasingly recognizing the value of genomic testing in enhancing patient care and reducing long-term healthcare costs. As of 2025, several countries have implemented reimbursement policies that cover genomic urine tests, making them more accessible to patients. This regulatory backing not only encourages healthcare providers to adopt these tests but also instills confidence in patients regarding their affordability. The alignment of regulatory support with market needs is likely to catalyze growth in the genomic urine testing sector.