Market Share

Generative AI in Data Analytics Market Share Analysis

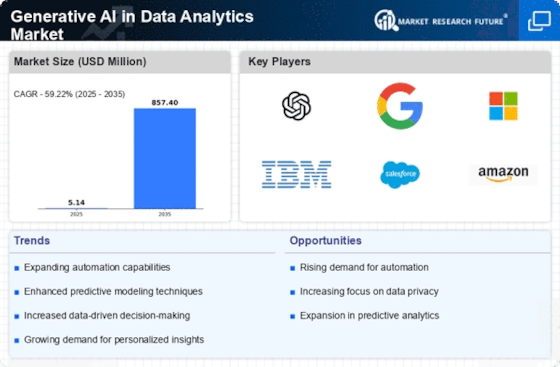

Generative AI has been making great strides in the data analytics marketplace, and its marketplace proportion positioning strategies are critical for its success. One of the primary strategies is differentiation, wherein Generative AI distinguishes itself from different data analytics solutions by emphasizing its capacity to create new, practical records based on current patterns. This sets it apart from traditional analytics tools, which, on the whole, cognizance of reading present facts. Another key method is focused advertising and schooling. Generative AI groups can strategically target industries and agencies that could gain the most from its capabilities. By focusing on sectors that include finance, healthcare, and advertising and marketing, Generative AI can tailor its advertising efforts to showcase how its era can deal with precise industry challenges. Additionally, offering educational assets and case research that reveal the realistic programs of Generative AI in data analytics can assist in constructing credibility and drive adoption inside these focused sectors. Collaboration and integration with current data analytics platforms are also essential marketplace positioning approaches for Generative AI. By partnering with hooked-up analytics providers, Generative AI can integrate its era into extensively used systems, making it easier for agencies already invested in these solutions. This approach allows Generative AI to leverage the prevailing user base of those systems and increase its market attain without the need for considerable standalone adoption efforts. Furthermore, pricing and packaging techniques play a crucial function in Generative AI's market positioning. Offering flexible pricing models, together with pay-as-you-pass or tiered subscription plans, could make Generative AI extra attractive to companies of varying sizes and price range constraints. Additionally, bundling Generative AI with complementary data analytics gear or services can create additional prices for customers and differentiate it from competitors inside the marketplace. Moreover, idea leadership and enterprise advocacy can raise Generative AI's market positioning. By actively taking part in enterprise activities, publishing white papers, and contributing to discussions on the destiny of data analytics, Generative AI organizations can set themselves up as leaders in the area. Lastly, non-stop innovation and R&D investment are essential for maintaining a strong market position. Generative AI must consistently enhance its technology, expand its capabilities, and stay ahead of evolving data analytics trends. By investing in research and development, Generative AI can demonstrate its commitment to pushing the boundaries of data analytics, which can attract forward-thinking businesses seeking cutting-edge solutions.

Leave a Comment