Growing Focus on Cost Efficiency

Cost efficiency is a pivotal driver in the web scale-it market, as businesses in the GCC strive to optimize their IT expenditures. Organizations are increasingly seeking solutions that provide high performance at lower costs, leading to a shift towards more efficient resource utilization. This trend is underscored by the fact that companies are looking to reduce operational costs by up to 20% through the adoption of web scale-it solutions. By leveraging cloud technologies and virtualization, businesses can achieve significant savings while maintaining service quality. This focus on cost efficiency is likely to propel the growth of the web scale-it market, as organizations prioritize solutions that deliver value without compromising on performance.

Investment in Advanced Technologies

Investment in advanced technologies is a critical driver for the web scale-it market, particularly in the GCC region. Organizations are increasingly allocating budgets towards cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics. These technologies enable businesses to optimize their operations and improve decision-making processes. According to recent data, investments in IT infrastructure are projected to grow by 15% annually, indicating a robust commitment to enhancing technological capabilities. This influx of capital is likely to foster innovation within the web scale-it market, as companies seek to leverage these advancements to gain a competitive edge and improve service delivery.

Rising Demand for Scalable Solutions

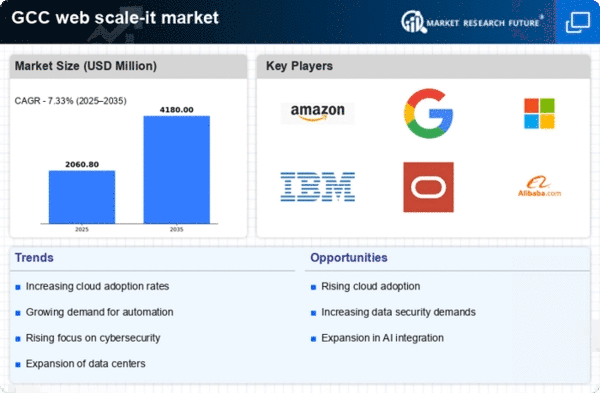

The web scale-it market is experiencing a notable surge in demand for scalable solutions, driven by the increasing need for businesses in the GCC to manage vast amounts of data efficiently. As organizations expand their digital footprint, the ability to scale IT resources seamlessly becomes paramount. This trend is reflected in the projected growth of the market, which is expected to reach approximately $2 billion by 2026. Companies are seeking solutions that not only accommodate current needs but also allow for future growth without significant overhauls. This demand for scalability is pushing vendors to innovate and offer more flexible, adaptable solutions that can cater to diverse business requirements, thereby enhancing the overall competitiveness of the web scale-it market.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are becoming increasingly significant in the web scale-it market, particularly as GCC countries implement stricter data protection laws. Organizations are compelled to ensure that their IT solutions comply with local regulations, which often necessitates the use of local data centers and services. This shift is likely to drive demand for web scale-it solutions that can guarantee compliance while maintaining operational efficiency. As a result, companies are investing in technologies that not only meet regulatory requirements but also enhance data security and privacy. The emphasis on compliance is expected to shape the strategic direction of the web scale-it market, influencing vendor offerings and customer preferences.

Enhanced Collaboration and Remote Work Capabilities

The need for enhanced collaboration and remote work capabilities is driving growth in the web scale-it market. As organizations in the GCC adapt to evolving work environments, there is a growing demand for IT solutions that facilitate seamless collaboration among distributed teams. This trend is reflected in the increasing adoption of cloud-based platforms and tools that support remote work. Companies are investing in web scale-it solutions that enable real-time communication and collaboration, which is essential for maintaining productivity in a hybrid work model. The emphasis on collaboration is likely to shape the future landscape of the web scale-it market, as businesses seek to implement solutions that foster teamwork and innovation.