GCC Virtualized Evolved Packet Core Market Segment Insights

Virtualized Evolved Packet Core Market Component Insights

The Component segment of the GCC Virtualized Evolved Packet Core Market exhibits significant growth potential, driven primarily by the adoption of advanced technologies aimed at optimizing mobile network performance. Within this segment, the market splits into two principal categories: Solution and Services. Solutions encompass a variety of virtualized network functions, which play a crucial role in enhancing network agility and scalability for telecommunications operators across the Gulf Cooperation Council region. Meanwhile, Services cover essential offerings such as integration, support, and maintenance that ensure the continued efficiency and reliability of deployed systems.

The GCC region has seen a rapid increase in mobile data traffic, spurred by digital transformation initiatives from the government and private sectors, leading to high demand for robust virtualized solutions and services. Moreover, the growing pressure on telecom operators to reduce operational costs while maintaining high levels of service quality has necessitated the adoption of virtualized technology. The importance of this Component segment is underscored by the rising need for operators to future-proof their networks against increasing data consumption and evolving customer expectations.As the telecommunications landscape in the GCC continues to mature, the emphasis on efficient, flexible, and scalable network solutions remains crucial, ensuring that the Component segment plays a pivotal role in shaping the future of the GCC Virtualized Evolved Packet Core Market.

The ongoing investment in smart city projects and the push toward the Internet of Things further enhance the demand for advanced network capabilities, reinforcing the significance of both Solutions and Services within the market. Both categories are poised to capitalize on emerging opportunities created by technological advancements such as 5G deployments, which promise to transform the telecommunications ecosystem in the GCC, reinforcing the necessity for comprehensive and adaptive solutions.As this market evolves, exploring opportunities within the Component segment will be essential for stakeholders aiming to capitalize on the growing digital landscape throughout the GCC region.

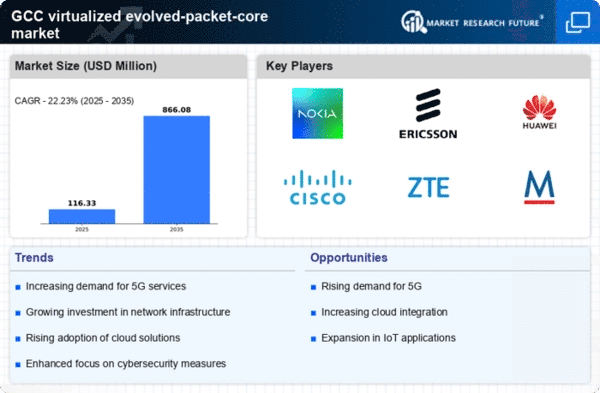

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Virtualized Evolved Packet Core Market Deployment Insights

The Deployment segment of the GCC Virtualized Evolved Packet Core Market plays a crucial role in the overall market dynamics. With the rising demand for seamless connectivity and enhanced mobile broadband services across the Gulf Cooperation Council region, organizations are increasingly adopting deployment strategies tailored to their operational needs. On-Premise deployment offers businesses control and customization, appealing to those prioritizing data privacy and security, especially as data regulations tighten in the region.

On the other hand, On-Cloud deployment is gaining traction for its scalability, flexibility, and cost-effectiveness, enabling telecom operators to quickly adapt to changing consumer demands without heavy upfront investments.This trend is fueled by the GCC government's commitment to digital transformation and the enhancement of smart city initiatives, leading to a more connected ecosystem. Market growth in this segment reflects the ongoing transition to more agile and efficient network infrastructures, with companies seeking innovative solutions to meet the increasing data traffic. Overall, both On-premises and On-cloud deployment strategies are integral for service providers aiming to optimize their infrastructure in a region characterized by rapid technological advancement and increasing consumer expectations.

Virtualized Evolved Packet Core Market Applications Insights

The Applications segment of the GCC Virtualized Evolved Packet Core Market is evolving rapidly, driven by the increasing demand for advanced mobile network capabilities and seamless connectivity. Key components such as LTE, VoLTE, VOWiFi, IoT, M2M, Mobile Private Networks (MPN), and Mobile Virtual Network Operators (MVNO) play a crucial role in shaping this market landscape. LTE technology enhances mobile broadband experiences, while VoLTE and VOWiFi provide high-definition voice services, contributing significantly to user satisfaction.

The IoT and M2M applications enable smarter cities and extensive automation, crucial for economic diversification in GCC countries, aligning with national visions like Saudi Arabia's Vision 2030.MPNs are gaining traction as businesses pursue secure and dedicated networks for mission-critical applications. MVNOs are also emerging as key players, creating competitive pricing and service differentiation strategies by offering more flexible user plans. Overall, these applications are not only enhancing 4G and forthcoming 5G deployments but also driving overall market growth by addressing the increasing connectivity demands across various sectors in the GCC region.

Virtualized Evolved Packet Core Market End-User Insights

The End-User segment of the GCC Virtualized Evolved Packet Core Market plays a crucial role in shaping the overall industry landscape, primarily categorized into Telecom Operators and Enterprises. Telecom Operators are vital as they leverage virtualized technologies to improve service delivery and network efficiency, thereby supporting the rising demand for high-speed data and enhanced connectivity within the region. As the GCC countries embrace digital transformation initiatives, the telecommunications sector is poised for significant expansion, necessitating robust infrastructure investments.

Enterprises are also experiencing a paradigm shift, as they seek to adopt virtualized solutions to drive operational efficiencies and enhance customer experiences. This growing enterprise focuses on digital solutions, reflects a broader trend towards technological adoption across various sectors in the GCC. Overall, the combination of increased data consumption, the adoption of 5G networks, and the ongoing push for modernization in both telecom and enterprise landscapes underscores the importance of the End-User segment in the GCC Virtualized Evolved Packet Core Market.