Expansion of Veterinary Practices

The expansion of veterinary practices across the GCC region is a critical driver for the veterinary ct-scanner market. As more veterinary clinics and hospitals open, the demand for advanced imaging technologies, such as ct-scanners, is likely to increase. This expansion is fueled by a growing awareness of animal health and welfare among pet owners, leading to higher visitation rates to veterinary facilities. Additionally, the veterinary ct-scanner market benefits from the integration of these technologies into new and existing practices, enhancing diagnostic capabilities. The market is projected to reach a valuation of over $100 million by 2027, indicating robust growth potential driven by this expansion.

Growing Awareness of Animal Health

Growing awareness of animal health among pet owners is a pivotal driver for the veterinary ct-scanner market. As pet owners become more informed about the importance of regular health check-ups and advanced diagnostic procedures, the demand for veterinary ct-scanners is expected to rise. This heightened awareness is leading to an increase in preventive care practices, which often require advanced imaging for accurate diagnosis. Consequently, veterinary practices are investing in ct-scanners to meet the expectations of informed pet owners. The veterinary ct-scanner market is likely to see a surge in adoption rates, as more clinics recognize the value of these technologies in providing comprehensive care.

Increased Investment in Veterinary Research

Increased investment in veterinary research is significantly impacting the veterinary ct-scanner market. Research institutions and universities in the GCC are allocating more resources towards veterinary sciences, which includes the development of advanced imaging technologies. This investment not only enhances the capabilities of veterinary professionals but also fosters innovation in diagnostic tools. The veterinary ct-scanner market stands to benefit from these advancements, as new technologies emerge from research initiatives. Furthermore, collaborations between veterinary practices and research institutions are likely to lead to improved imaging techniques, thereby increasing the adoption of ct-scanners in clinical settings.

Rising Demand for Advanced Diagnostic Tools

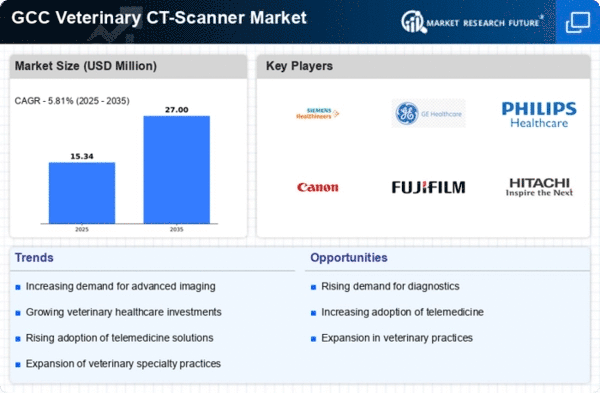

The Veterinary CT-Scanner Market is experiencing a notable increase in demand for advanced diagnostic tools. This trend is driven by the growing need for accurate and timely diagnosis of various animal health conditions. As veterinary practices in the GCC region adopt more sophisticated technologies, the market for veterinary ct-scanners is projected to expand significantly. The increasing prevalence of chronic diseases in pets necessitates advanced imaging techniques, which are essential for effective treatment planning. Furthermore, the veterinary ct-scanner market is expected to witness a compound annual growth rate (CAGR) of approximately 8% over the next five years, reflecting the rising investment in veterinary healthcare infrastructure.

Regulatory Support for Veterinary Technologies

Regulatory support for veterinary technologies is emerging as a significant driver for the veterinary ct-scanner market. Governments in the GCC region are increasingly recognizing the importance of advanced diagnostic tools in improving animal health outcomes. This support includes streamlined approval processes for new veterinary technologies, which encourages manufacturers to innovate and bring new products to market. As regulatory frameworks evolve, the veterinary ct-scanner market is expected to benefit from increased availability and accessibility of advanced imaging solutions. This supportive environment may lead to a projected market growth of approximately 10% over the next few years, as more veterinary practices adopt these technologies.