Focus on Preventive Healthcare

The focus on preventive healthcare is emerging as a significant driver for the telemedicine market in the GCC. With an increasing awareness of health and wellness, patients are seeking proactive measures to manage their health. Telemedicine services that offer preventive care, such as remote monitoring and health assessments, are gaining traction. Data indicates that preventive healthcare can reduce overall healthcare costs by up to 30%, making it an attractive option for both patients and providers. As the emphasis on preventive measures continues to grow, the telemedicine market is likely to expand, offering innovative solutions that cater to this demand.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in the expansion of the telemedicine market within the GCC. Various governments are actively investing in digital health infrastructure to enhance healthcare delivery systems. For instance, initiatives aimed at increasing telehealth accessibility have been launched, with budgets allocated to support the development of telemedicine platforms. In 2025, it is estimated that government spending on digital health solutions in the GCC will reach approximately $1 billion, reflecting a commitment to improving healthcare access. These efforts not only foster innovation but also encourage private sector participation, thereby creating a conducive environment for the growth of the telemedicine market.

Changing Patient Preferences and Behavior

Changing patient preferences and behavior are reshaping the telemedicine market in the GCC. Patients are increasingly favoring telehealth services due to their convenience and flexibility. Surveys indicate that over 70% of patients in the region express a preference for virtual consultations over traditional in-person visits. This shift is particularly evident among younger demographics who are more tech-savvy and accustomed to digital solutions. As patients become more proactive in managing their health, the demand for telemedicine services is expected to rise. This evolving landscape suggests that healthcare providers must adapt their offerings to align with patient expectations, thereby driving further growth in the telemedicine market.

Technological Advancements in Communication

Technological advancements in communication are significantly influencing the telemedicine market in the GCC. The proliferation of high-speed internet and mobile connectivity has made it easier for patients to access telehealth services. As of November 2025, mobile penetration in the GCC is estimated to be around 90%, facilitating seamless communication between healthcare providers and patients. Furthermore, the integration of artificial intelligence and machine learning into telemedicine platforms enhances diagnostic accuracy and patient engagement. These innovations not only improve the quality of care but also streamline operations for healthcare providers, thereby driving growth in the telemedicine market. The ongoing evolution of technology suggests a promising future for telemedicine services in the region.

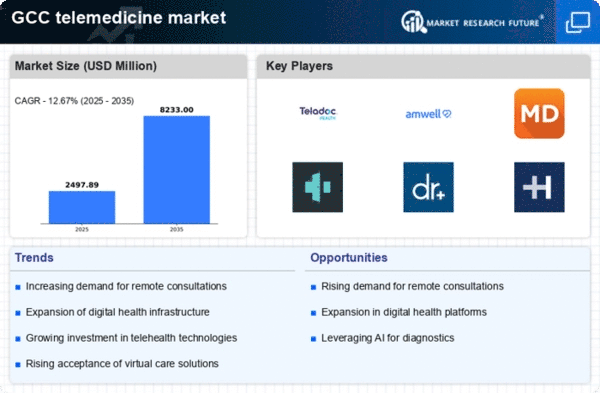

Rising Demand for Remote Healthcare Solutions

The telemedicine market is experiencing a notable surge in demand for remote healthcare solutions across the GCC region. This trend is driven by an increasing population that seeks convenient access to medical services without the need for physical visits. According to recent data, the GCC healthcare sector is projected to grow at a CAGR of approximately 12% over the next five years, indicating a robust market for telemedicine services. Patients are increasingly opting for virtual consultations, which not only save time but also reduce the risk of exposure to infections. This shift towards remote healthcare is likely to reshape the landscape of the telemedicine market, as healthcare providers adapt to meet the evolving needs of their patients.