Rising Demand for Visual Communication

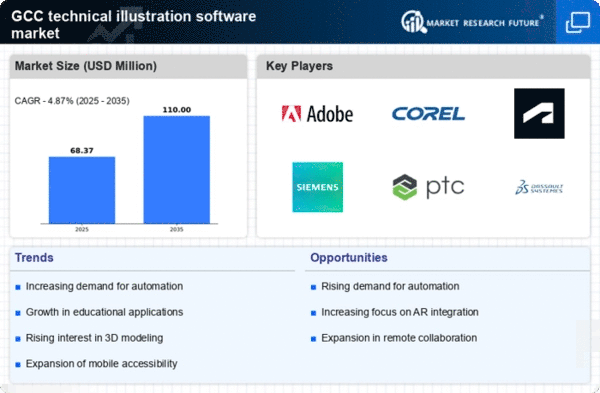

The technical illustration-software market is experiencing a notable increase in demand for visual communication tools. As industries such as engineering, manufacturing, and education in the GCC region continue to evolve, the need for clear and effective visual representations of complex information becomes paramount. This trend is driven by the necessity for businesses to convey intricate ideas succinctly, thereby enhancing understanding and collaboration. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust appetite for advanced illustration solutions. Companies are increasingly investing in software that can produce high-quality graphics, which is essential for technical documentation and marketing materials. This rising demand is likely to propel innovation within the technical illustration-software market, leading to the development of more sophisticated tools that cater to diverse industry needs.

Growing Emphasis on Compliance and Standards

The technical illustration-software market is being shaped by a growing emphasis on compliance and industry standards within the GCC region. As regulatory requirements become more stringent across various sectors, companies are compelled to adopt software solutions that ensure adherence to these standards. This trend is particularly evident in industries such as healthcare, aerospace, and manufacturing, where accurate technical illustrations are critical for compliance documentation. The need for software that can produce illustrations meeting specific regulatory criteria is driving demand in the market. It is estimated that compliance-related software features could account for up to 30% of the total software functionalities sought by organizations. This focus on compliance not only enhances operational efficiency but also mitigates risks associated with non-compliance, thereby reinforcing the importance of robust technical illustration tools.

Expansion of E-Learning and Remote Collaboration

The expansion of e-learning and remote collaboration is significantly impacting the technical illustration-software market. With the increasing shift towards online education and remote work environments in the GCC, there is a heightened need for tools that facilitate effective communication and collaboration among teams. Technical illustrations play a vital role in e-learning platforms, as they help convey complex concepts in an easily digestible format. The market is witnessing a surge in demand for software that supports collaborative features, such as real-time editing and sharing capabilities. Recent studies indicate that the e-learning market in the GCC is expected to grow by 25% over the next few years, which could drive further adoption of technical illustration software tailored for educational purposes. This trend highlights the importance of integrating collaborative functionalities into illustration tools to meet the evolving needs of users.

Increased Investment in Training and Development

Investment in training and development is emerging as a crucial driver for the technical illustration-software market. Organizations in the GCC are recognizing the importance of equipping their workforce with the necessary skills to effectively utilize advanced illustration tools. This focus on professional development is likely to enhance productivity and creativity within teams, ultimately leading to better project outcomes. As companies allocate more resources towards training programs, the demand for user-friendly software that facilitates learning is expected to rise. Reports indicate that organizations are increasing their training budgets by approximately 20% annually, which could significantly impact the adoption of technical illustration software. This trend underscores the importance of not only having advanced tools but also ensuring that personnel are adequately trained to leverage these technologies effectively.

Technological Advancements in Software Capabilities

Technological advancements are significantly influencing the technical illustration-software market, particularly in the GCC region. The integration of artificial intelligence and machine learning into illustration tools is enhancing their capabilities, allowing for more efficient workflows and improved output quality. These innovations enable users to automate repetitive tasks, thereby saving time and reducing errors. Furthermore, the introduction of 3D modeling and rendering features is transforming how technical illustrations are created and utilized. As a result, companies are increasingly adopting these advanced tools to stay competitive. Market analysis suggests that the adoption rate of such technologies is expected to rise by 15% in the coming years, reflecting a shift towards more sophisticated software solutions. This trend indicates a growing recognition of the value that advanced technical illustration software can bring to various sectors, including architecture, engineering, and product design.