Growth in Glass Manufacturing

The growth of the glass manufacturing industry in the GCC is benefiting silica sand.. As the demand for glass products, including containers, flat glass, and fiberglass, continues to rise, the need for high-purity silica sand is becoming increasingly critical. The glass manufacturing sector in the GCC is expected to grow at a CAGR of around 5% over the next five years, driven by both domestic consumption and export opportunities. This growth trajectory suggests a sustained demand for silica sand, which is a primary raw material in glass production. Additionally, the increasing focus on sustainable packaging solutions is likely to further enhance the demand for glass products, thereby positively impacting the silica sand market. Manufacturers are thus encouraged to align their production capabilities to meet the evolving needs of the glass industry.

Oil and Gas Sector Utilization

The silica sand market is significantly influenced by its applications in the oil and gas sector, particularly in hydraulic fracturing processes. The GCC region, being rich in hydrocarbon resources, has seen a surge in exploration and production activities, which require high-quality silica sand for fracking. The demand for silica sand in this context is projected to grow as the oil and gas industry continues to expand its operations. Reports suggest that the market for silica sand used in hydraulic fracturing could reach approximately $1 billion by 2026, indicating a strong correlation between the oil and gas sector and the silica sand market. This relationship underscores the importance of silica sand as a critical input in energy production, thereby enhancing its market potential within the GCC.

Infrastructure Development Initiatives

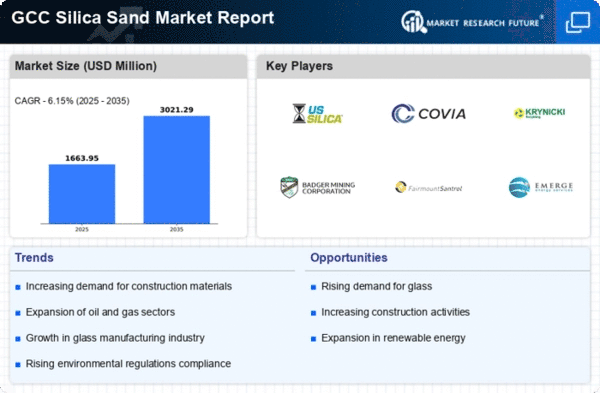

A notable boost is occurring due to extensive infrastructure development initiatives across the GCC region.. Governments are investing heavily in projects such as roads, bridges, and airports, which require substantial quantities of silica sand for concrete and asphalt production. For instance, the GCC construction sector is projected to grow at a CAGR of approximately 6% from 2025 to 2030, driving demand for raw materials, including silica sand. This trend indicates a robust pipeline of construction activities, which is likely to sustain the growth of the silica sand market. Furthermore, the increasing urbanization in GCC countries is expected to further amplify the need for construction materials, thereby enhancing the market dynamics for silica sand. As a result, stakeholders in the silica sand market are poised to benefit from these ongoing infrastructure projects.

Rising Demand for Foundry Applications

Growth is also occurring due to the rising demand for foundry applications in the GCC region.. Foundries utilize silica sand as a key component in metal casting processes, which are essential for various industries, including automotive and aerospace. The GCC's manufacturing sector is anticipated to expand, with a projected growth rate of approximately 4% annually, thereby increasing the demand for foundry-grade silica sand. This trend indicates a robust market for silica sand, as foundries seek high-quality sand to produce intricate metal components. Furthermore, the ongoing industrialization in the GCC is likely to create additional opportunities for silica sand suppliers, as manufacturers increasingly rely on advanced casting techniques that require superior sand quality. Consequently, the silica sand market is well-positioned to capitalize on these developments.

Environmental Regulations and Quality Standards

Stringent environmental regulations and quality standards imposed by GCC governments are shaping the market.. These regulations aim to ensure that silica sand extraction and processing activities adhere to sustainable practices, which may influence market dynamics. Compliance with these standards often necessitates investments in advanced processing technologies, which could lead to increased operational costs for producers. However, this also presents an opportunity for market players to differentiate themselves by offering high-quality, environmentally compliant silica sand. The emphasis on quality is likely to drive innovation within the silica sand market, as companies strive to meet the evolving regulatory landscape. As a result, while challenges may arise from compliance costs, the potential for enhanced product offerings could ultimately benefit the silica sand market in the GCC.