Integration of Telehealth Services

The integration of telehealth services within the GCC healthcare framework is significantly influencing the patient temperature-monitoring market. As healthcare systems increasingly adopt telemedicine, the need for remote patient monitoring tools becomes essential. Temperature-monitoring devices that can seamlessly connect with telehealth platforms allow healthcare professionals to track patients' conditions in real-time, improving response times and patient engagement. The telehealth market in the GCC is projected to grow at a CAGR of over 25% in the coming years, suggesting a robust demand for compatible monitoring devices. This integration not only enhances patient convenience but also supports healthcare providers in delivering efficient care.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in the GCC region is a pivotal driver for the patient temperature-monitoring market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders necessitate regular monitoring of vital signs, including body temperature. As healthcare providers emphasize proactive management of these diseases, the demand for reliable temperature-monitoring devices is expected to surge. According to recent data, chronic diseases account for approximately 70% of total healthcare expenditures in the region, highlighting the need for effective monitoring solutions. This trend indicates a growing market for devices that can provide accurate and timely temperature readings, thereby enhancing patient care and outcomes.

Growing Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in the GCC, which is driving the patient temperature-monitoring market. As individuals become more health-conscious, there is an increasing emphasis on regular health check-ups and monitoring of vital signs. This trend is reflected in the rising sales of home monitoring devices, including thermometers. The market for home healthcare devices is expected to expand by approximately 15% annually. This indicates a strong consumer preference for accessible health monitoring solutions. This growing awareness encourages manufacturers to innovate and develop user-friendly temperature-monitoring devices that cater to the needs of health-conscious consumers.

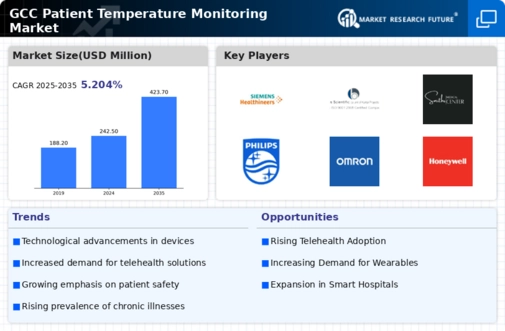

Technological Innovations in Monitoring Devices

Technological innovations are transforming the patient temperature-monitoring market in the GCC. The introduction of smart thermometers and wearable devices equipped with advanced sensors is enhancing the accuracy and convenience of temperature monitoring. These devices often feature connectivity options, allowing data to be shared with healthcare providers in real-time. The market for smart health devices is anticipated to grow by 20% annually, driven by consumer demand for innovative solutions. As technology continues to evolve, the patient temperature-monitoring market is likely to witness the emergence of more sophisticated devices that cater to the needs of both patients and healthcare professionals.

Government Initiatives for Healthcare Improvement

Government initiatives aimed at enhancing healthcare infrastructure in the GCC are playing a crucial role in the patient temperature-monitoring market. Various national health programs are being implemented to improve healthcare access and quality, which includes the promotion of advanced monitoring technologies. Investments in healthcare technology are projected to reach $10 billion by 2027, reflecting a commitment to modernize healthcare services. These initiatives not only facilitate the adoption of temperature-monitoring devices but also encourage research and development in this field, ultimately benefiting patient care and outcomes.