Expansion of the Gig Economy

The expansion of the gig economy is significantly impacting the mobile workforce-management market. As more individuals engage in freelance and contract work, organizations are adapting their workforce management strategies to accommodate this shift. The GCC region is witnessing a rise in gig workers, prompting companies to seek mobile solutions that can effectively manage a diverse workforce. This trend is expected to drive growth in the mobile workforce-management market, as businesses require tools that facilitate the onboarding, scheduling, and payment of gig workers. The flexibility offered by mobile applications is appealing to both employers and workers, fostering a more dynamic labor market. As the gig economy continues to grow, the demand for tailored mobile workforce-management solutions is likely to increase.

Rising Demand for Remote Work Solutions

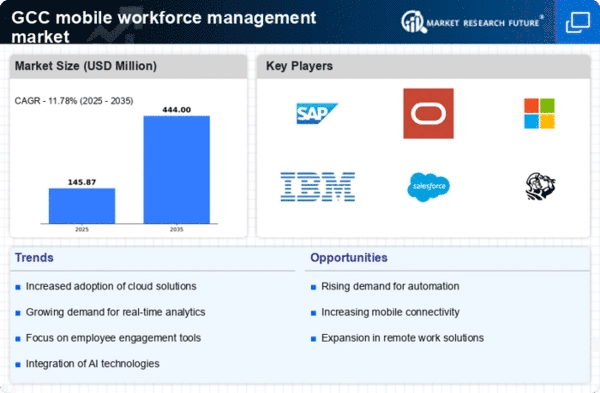

The market is experiencing a notable surge in demand for remote work solutions across the GCC region. As organizations increasingly adopt flexible work arrangements, the need for effective management tools becomes paramount. This shift is driven by the desire to enhance productivity and maintain operational efficiency. According to recent data, The mobile workforce-management market is expected to grow at a CAGR of approximately 15% over the next five years in the GCC. Companies are investing in mobile applications that facilitate communication, task management, and performance tracking, thereby ensuring that remote teams remain connected and engaged. This trend indicates a significant transformation in workplace dynamics, necessitating robust solutions that cater to the evolving needs of the workforce.

Increased Focus on Compliance and Regulation

The mobile workforce-management market is also influenced by the increasing focus on compliance and regulatory requirements within the GCC. Organizations are under pressure to adhere to various labor laws and regulations, which necessitates the implementation of effective workforce management solutions. This trend is particularly relevant in sectors such as construction and healthcare, where compliance is critical. As a result, companies are investing in mobile workforce-management tools that help ensure adherence to legal standards and improve reporting capabilities. The market is likely to see a rise in demand for solutions that offer compliance tracking features, thereby enhancing operational transparency and reducing the risk of legal issues. This focus on compliance is expected to drive growth in the mobile workforce-management market.

Growing Importance of Data-Driven Decision Making

Data-driven decision making is becoming increasingly vital in the mobile workforce-management market. Organizations in the GCC are recognizing the value of leveraging data analytics to optimize workforce performance and resource allocation. By utilizing mobile workforce-management solutions that provide insights into employee productivity and operational efficiency, companies can make informed decisions that enhance overall performance. The market is projected to grow as businesses seek to harness the power of data analytics to drive strategic initiatives. This trend indicates a shift towards more analytical approaches in workforce management, where data is used to identify trends, forecast needs, and improve employee engagement. As data becomes a central component of decision-making processes, the mobile workforce-management market is likely to expand.

Technological Advancements in Mobile Applications

Technological advancements are playing a crucial role in shaping the mobile workforce-management market. Innovations in mobile applications, such as improved user interfaces and enhanced functionalities, are making it easier for organizations to manage their workforce effectively. The integration of features like real-time tracking, automated reporting, and data analytics is becoming increasingly common. In the GCC, the mobile workforce-management market is expected to reach a valuation of $1 billion by 2026, driven by these technological enhancements. Companies are leveraging these advancements to streamline operations, reduce costs, and improve decision-making processes. As technology continues to evolve, it is likely that the market will witness further innovations that enhance the capabilities of mobile workforce-management solutions.