Increasing Cyber Threat Landscape

The extended detection-response market is experiencing growth due to the escalating cyber threat landscape in the GCC region. Organizations are increasingly targeted by sophisticated cyber attacks, which necessitate advanced security solutions. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, with a significant portion of this impact felt in the GCC. As a result, companies are investing in extended detection-response solutions to enhance their security posture and mitigate risks. This trend indicates a growing recognition of the need for comprehensive threat detection and response capabilities, driving demand for innovative solutions in the extended detection-response market.

Demand for Real-Time Threat Intelligence

The extended detection-response market is being propelled by the rising demand for real-time threat intelligence among organizations in the GCC. As cyber threats evolve rapidly, businesses require timely and actionable insights to respond effectively. The market for threat intelligence solutions is projected to grow at a CAGR of 20% through 2026, highlighting the urgency for organizations to adopt advanced detection and response mechanisms. This demand is particularly pronounced in sectors such as finance and healthcare, where data breaches can have severe consequences. Consequently, the extended detection-response market is positioned to benefit from this trend as organizations seek to integrate real-time intelligence into their security frameworks.

Growing Awareness of Cybersecurity Risks

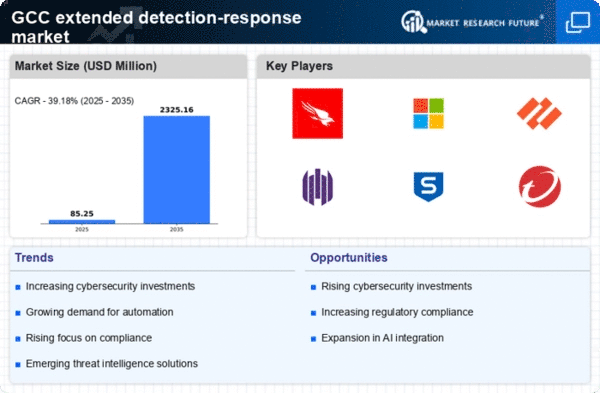

The extended detection-response market is benefiting from a growing awareness of cybersecurity risks among businesses in the GCC. As high-profile cyber incidents make headlines, organizations are becoming more cognizant of the potential repercussions of inadequate security measures. This heightened awareness is prompting companies to invest in advanced detection and response solutions to safeguard their operations. In 2025, it is projected that cybersecurity spending in the region will surpass $5 billion, reflecting a commitment to enhancing security frameworks. This trend suggests that organizations are prioritizing cybersecurity as a critical component of their overall business strategy, thereby driving growth in the extended detection-response market.

Shift Towards Cloud-Based Security Solutions

The extended detection-response market is witnessing a shift towards cloud-based security solutions, driven by the increasing adoption of cloud technologies in the GCC. Organizations are migrating their operations to the cloud, which necessitates robust security measures to protect sensitive data. In 2025, it is anticipated that cloud security spending in the region will exceed $3 billion, reflecting a growing recognition of the need for scalable and flexible security solutions. This trend is likely to enhance the demand for extended detection-response solutions that can seamlessly integrate with cloud environments, thereby providing comprehensive protection against emerging threats.

Regulatory Pressures and Compliance Requirements

The extended detection-response market is influenced by regulatory pressures and compliance requirements in the GCC. Governments are implementing stringent regulations to safeguard sensitive data, particularly in sectors such as finance and healthcare. Organizations are compelled to adopt advanced security measures to comply with these regulations, which is driving the demand for extended detection-response solutions. In 2025, it is expected that compliance-related spending in the region will reach $1.5 billion, underscoring the importance of regulatory adherence. This trend indicates that organizations are increasingly recognizing the value of investing in comprehensive security solutions to meet compliance standards and protect their assets.