Growth in Data Centers

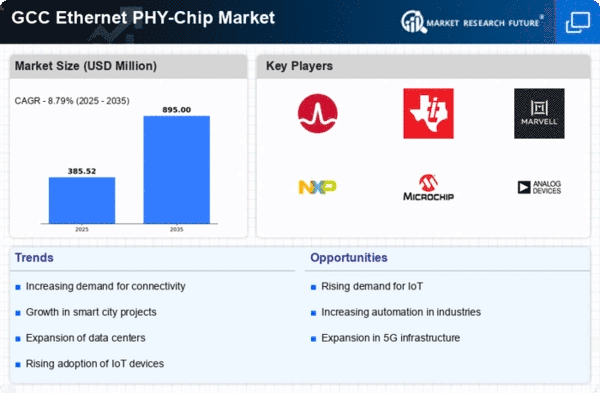

The expansion of data centers in the GCC region serves as a significant catalyst for the ethernet phy-chip market. With the increasing reliance on cloud computing and data storage solutions, the demand for data centers has surged. Reports suggest that the GCC data center market is expected to grow at a CAGR of around 10% over the next few years. This growth directly correlates with the need for high-performance networking solutions, including ethernet phy-chips, to facilitate efficient data transfer and management. As data centers evolve to accommodate larger volumes of data, the ethernet phy-chip market is likely to experience increased demand for advanced technologies that support higher speeds and improved reliability.

Expansion of Smart Cities

The ongoing development of smart cities in the GCC region significantly influences the ethernet phy-chip market. Governments are investing heavily in infrastructure to enhance urban living through technology. This includes the deployment of smart grids, intelligent transportation systems, and connected public services. As these initiatives progress, the demand for efficient networking solutions, including ethernet phy-chips, is expected to rise. The market is projected to grow as these technologies require reliable and high-speed data transmission capabilities. Furthermore, the integration of IoT devices within smart city frameworks necessitates advanced ethernet phy-chips to ensure seamless connectivity and data exchange, thereby driving market expansion.

Increased Internet Penetration

The rapid increase in internet penetration across the GCC region is a primary driver for the Ethernet PHY-Chip Market. As more households and businesses gain access to high-speed internet, the demand for reliable networking solutions intensifies. Reports indicate that internet penetration in GCC countries has reached approximately 99%, leading to a surge in data traffic. This growth necessitates advanced ethernet phy-chips to support higher bandwidth and lower latency. Consequently, manufacturers are focusing on developing innovative solutions to meet the evolving needs of consumers and enterprises. The ethernet phy-chip market is likely to benefit from this trend, as the need for robust connectivity solutions becomes increasingly critical in both urban and rural areas.

Rising Adoption of IoT Devices

The proliferation of IoT devices across various sectors in the GCC region is a key driver for the ethernet phy-chip market. As industries such as healthcare, manufacturing, and transportation increasingly adopt IoT solutions, the need for reliable and efficient networking components becomes paramount. The ethernet phy-chip market is poised to benefit from this trend, as these devices require robust connectivity to function effectively. With estimates indicating that the number of connected IoT devices in the GCC could reach over 1 billion by 2026, the demand for ethernet phy-chips is likely to rise significantly. This growth presents opportunities for manufacturers to innovate and develop specialized solutions tailored to the unique requirements of IoT applications.

Investment in Telecommunications Infrastructure

Significant investments in telecommunications infrastructure across the GCC region are driving the ethernet phy-chip market. Governments and private entities are focusing on enhancing network capabilities to support the growing demand for digital services. This includes upgrading existing networks and deploying new technologies such as 5G. The expansion of telecommunications infrastructure is expected to create a favorable environment for the ethernet phy-chip market, as these components are essential for ensuring high-speed data transmission. As the region continues to modernize its telecommunications landscape, the demand for advanced ethernet phy-chips is likely to increase, providing opportunities for growth and innovation within the market.