Growing Focus on User Experience

User experience (UX) has emerged as a critical factor influencing the enterprise mobile-application-development-platform market. Organizations in the GCC are increasingly prioritizing UX design to ensure that mobile applications are intuitive and user-friendly. This focus on UX is driven by the understanding that a positive user experience can lead to higher customer satisfaction and retention rates. Research indicates that applications with superior UX can see engagement rates increase by up to 50%. As businesses strive to create compelling mobile experiences, the demand for platforms that offer advanced UX design capabilities is likely to rise, further propelling the enterprise mobile-application-development-platform market.

Government Initiatives and Support

Government initiatives in the GCC region play a pivotal role in fostering the enterprise mobile-application-development-platform market. Various national strategies aim to promote digital transformation across sectors, encouraging businesses to adopt mobile technologies. For instance, initiatives such as Saudi Vision 2030 and the UAE's Digital Government Strategy emphasize the importance of technology in enhancing public services and economic diversification. These efforts are likely to stimulate investments in mobile application development, as organizations seek to align with government objectives. The enterprise mobile-application-development-platform market stands to benefit significantly from such supportive policies, which may lead to increased funding and resources for mobile development projects.

Rising Demand for Mobile Solutions

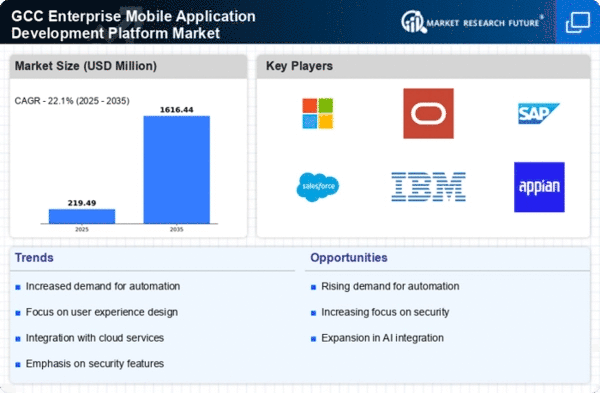

The enterprise mobile-application-development-platform market experiences a notable surge in demand as organizations in the GCC increasingly recognize the necessity of mobile solutions. This trend is driven by the need for enhanced customer engagement and operational efficiency. According to recent data, mobile applications are projected to account for over 70% of total digital interactions by 2025. As businesses strive to meet customer expectations, the demand for robust mobile applications is likely to escalate, thereby propelling the growth of the enterprise mobile-application-development-platform market. Companies are investing in platforms that facilitate rapid development and deployment of mobile applications, which is essential for maintaining competitive advantage in a fast-paced digital landscape.

Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is significantly impacting the enterprise mobile-application-development-platform market. Organizations in the GCC are increasingly adopting cloud technologies to facilitate scalability, flexibility, and cost-effectiveness in mobile application development. Cloud-based platforms allow for seamless collaboration among development teams and enable rapid deployment of applications. Recent statistics indicate that the cloud services market in the GCC is projected to reach $10 billion by 2026, highlighting the growing reliance on cloud infrastructure. This trend is likely to drive the demand for enterprise mobile-application-development-platforms that offer cloud integration, as businesses seek to leverage the advantages of cloud computing in their mobile strategies.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into mobile applications is transforming the enterprise mobile-application-development-platform market. AI technologies enable businesses to enhance functionality, personalize user experiences, and streamline operations. In the GCC, organizations are increasingly leveraging AI to analyze user data and improve decision-making processes. The market for AI in mobile applications is expected to grow at a CAGR of over 30% in the coming years. This trend suggests that platforms incorporating AI capabilities will be in high demand, as businesses seek to harness the power of data-driven insights to optimize their mobile applications and enhance overall performance.