Growing Emphasis on Remote Work

The enterprise file-synchronization-sharing market is witnessing a significant shift due to the growing emphasis on remote work arrangements in the GCC. As organizations adapt to flexible work models, the need for secure and efficient file-sharing solutions becomes paramount. Data indicates that approximately 60% of companies in the region are implementing remote work policies, which necessitate robust file synchronization and sharing capabilities. This trend is likely to propel the demand for enterprise file-synchronization-sharing solutions that facilitate seamless collaboration among remote teams. By enabling employees to access and share files securely from various locations, organizations can maintain productivity and ensure business continuity, thus driving growth in the enterprise file-synchronization-sharing market.

Increased Focus on Data Security

In the enterprise file-synchronization-sharing market, there is an increasing focus on data security as organizations in the GCC prioritize the protection of sensitive information. With the rise in cyber threats and data breaches, businesses are seeking solutions that offer advanced security features, such as encryption, access controls, and secure file sharing. Recent statistics reveal that nearly 70% of enterprises in the region consider data security a top priority when selecting file-sharing solutions. This heightened awareness is likely to drive innovation and investment in security features within the enterprise file-synchronization-sharing market, as companies strive to safeguard their data while ensuring compliance with regulatory requirements.

Regulatory Compliance Requirements

The enterprise file-synchronization-sharing market is significantly influenced by the regulatory compliance requirements that organizations in the GCC must adhere to. With the implementation of various data protection laws and regulations, businesses are increasingly seeking solutions that ensure compliance while managing their file-sharing needs. Recent reports indicate that over 80% of companies in the region are prioritizing compliance in their technology investments. This trend is likely to drive demand for enterprise file-synchronization-sharing solutions that offer features such as audit trails, data retention policies, and compliance reporting. By aligning their file-sharing practices with regulatory standards, organizations can mitigate risks and enhance their reputation, thereby contributing to the growth of the enterprise file-synchronization-sharing market.

Rising Adoption of Cloud Solutions

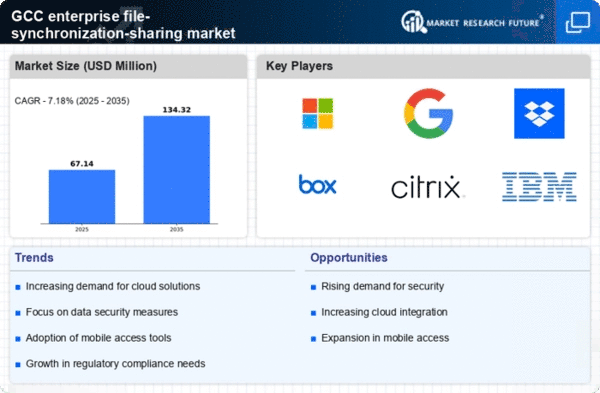

The enterprise file-synchronization-sharing market is experiencing a notable surge in the adoption of cloud-based solutions across various sectors in the GCC. Organizations are increasingly recognizing the benefits of cloud technology, which offers enhanced scalability, flexibility, and cost-effectiveness. According to recent data, the cloud services market in the GCC is projected to grow at a CAGR of approximately 20% over the next five years. This trend is likely to drive demand for enterprise file-synchronization-sharing solutions, as businesses seek to leverage cloud capabilities for efficient data management and collaboration. The integration of cloud solutions enables organizations to streamline workflows, improve accessibility, and enhance overall productivity, thereby fostering a more collaborative work environment.

Demand for Enhanced Collaboration Tools

The enterprise file-synchronization-sharing market is experiencing a growing demand for enhanced collaboration tools that facilitate teamwork and communication among employees. As organizations in the GCC increasingly adopt digital transformation strategies, the need for integrated solutions that support real-time collaboration becomes evident. Data suggests that approximately 75% of businesses in the region are investing in collaboration technologies to improve operational efficiency. This trend is likely to drive the development of enterprise file-synchronization-sharing solutions that offer features such as version control, simultaneous editing, and task management. By providing these capabilities, organizations can foster a more collaborative work environment, ultimately enhancing productivity and driving growth in the enterprise file-synchronization-sharing market.