Increased Healthcare Expenditure

Healthcare expenditure in the GCC region has been on the rise, contributing positively to the electric wheelchair market. Governments are investing heavily in healthcare infrastructure, which includes the provision of assistive devices for individuals with mobility challenges. This increased spending is likely to enhance access to electric wheelchairs, as healthcare providers are more inclined to offer these devices as part of their services. According to recent data, healthcare spending in the GCC is expected to reach $100 billion by 2025, indicating a robust market for medical devices, including electric wheelchairs. The electric wheelchair market stands to gain from this trend, as more individuals are likely to receive the necessary support to improve their mobility.

Expansion of Distribution Channels

The expansion of distribution channels is significantly influencing the electric wheelchair market. Retailers and online platforms are increasingly offering a wider range of electric wheelchairs, making them more accessible to consumers across the GCC. This trend is likely to enhance market penetration, as potential buyers can easily compare products and make informed decisions. The electric wheelchair market is benefiting from this expansion, as it allows manufacturers to reach a larger audience and cater to diverse consumer needs. Additionally, partnerships with healthcare providers and rehabilitation centers are facilitating the distribution of electric wheelchairs, ensuring that individuals in need have access to these essential mobility solutions.

Technological Innovations in Design

Technological innovations are playing a crucial role in shaping the electric wheelchair market. Manufacturers are increasingly focusing on developing advanced features such as lightweight materials, improved battery life, and smart technology integration. These innovations not only enhance the user experience but also make electric wheelchairs more appealing to a broader audience. The electric wheelchair market is witnessing a shift towards more sophisticated designs that cater to the specific needs of users, including customizable options. As technology continues to evolve, it is expected that the market will see a surge in demand for electric wheelchairs equipped with cutting-edge features, further driving growth.

Rising Demand for Mobility Solutions

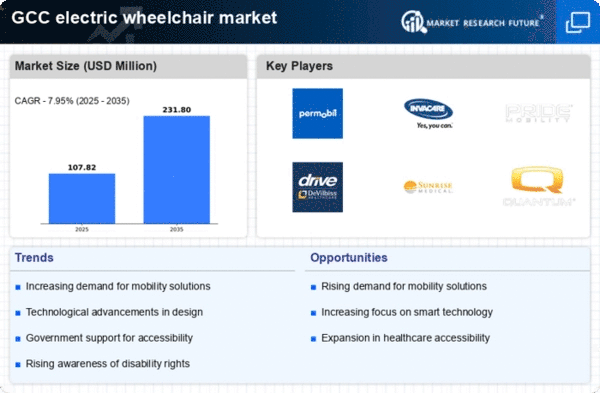

The electric wheelchair market is experiencing a notable increase in demand for mobility solutions across the GCC region. This trend is driven by a growing awareness of the importance of mobility for individuals with disabilities and the elderly. As the population ages, the need for assistive devices becomes more pronounced. Market data indicates that the demand for electric wheelchairs is projected to grow at a CAGR of approximately 8% over the next five years. This growth is further fueled by advancements in technology, which enhance the functionality and comfort of electric wheelchairs, making them more appealing to consumers. The electric wheelchair market is thus positioned to benefit from this rising demand, as manufacturers innovate to meet the needs of a diverse customer base.

Growing Awareness of Disability Rights

There is a growing awareness of disability rights within the GCC, which is positively impacting the electric wheelchair market. Advocacy for the rights of individuals with disabilities has led to increased demand for accessible solutions, including electric wheelchairs. This shift in societal attitudes is encouraging governments and organizations to invest in infrastructure that supports mobility for all. The electric wheelchair market is likely to benefit from this heightened awareness, as more individuals seek out electric wheelchairs as a means to enhance their independence and quality of life. Furthermore, this trend may lead to more inclusive policies that promote the availability of electric wheelchairs in public spaces.