Government Regulations and Policies

Stringent government regulations aimed at reducing carbon emissions are influencing the electric vehicle-ev-charging-infrastructure market. The GCC governments are implementing policies that promote the use of electric vehicles, including mandates for a certain percentage of new vehicle sales to be electric. These regulations create a favorable environment for the electric vehicle-ev-charging-infrastructure market, as they encourage investments in charging infrastructure. For instance, the Saudi Arabian government has set ambitious targets for EV adoption, which necessitates a robust charging network. Compliance with these regulations not only supports environmental goals but also positions the electric vehicle-ev-charging-infrastructure market for growth as stakeholders align their strategies with governmental objectives.

Rising Demand for Electric Vehicles

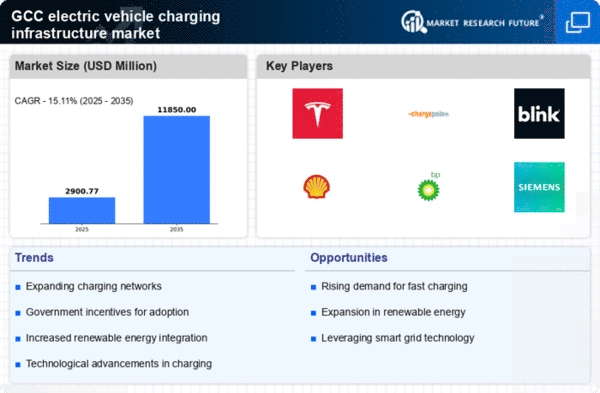

The increasing consumer interest in electric vehicles (EVs) is a primary driver for the electric vehicle-ev-charging-infrastructure market. In the GCC, the number of EVs is projected to rise significantly, with estimates suggesting a growth rate of around 30% annually. This surge in demand necessitates a corresponding expansion of charging infrastructure to accommodate the growing fleet of EVs. As more consumers opt for electric mobility, the need for accessible and efficient charging solutions becomes paramount. The electric vehicle-ev-charging-infrastructure market must adapt to this trend by enhancing the availability of charging stations, thereby ensuring that EV owners have convenient access to charging facilities. This shift not only supports the transition to sustainable transportation but also aligns with the GCC's broader environmental goals.

Investment in Renewable Energy Sources

The GCC region is increasingly investing in renewable energy sources, which is likely to bolster the electric vehicle-ev-charging-infrastructure market. With ambitious targets set for renewable energy generation, such as the UAE's goal to produce 50% of its energy from clean sources by 2050, the integration of renewable energy into EV charging solutions appears promising. This investment not only supports the sustainability of the electric vehicle ecosystem but also enhances the attractiveness of EVs to environmentally conscious consumers. The electric vehicle-ev-charging-infrastructure market stands to benefit from this trend, as charging stations powered by renewable energy can offer lower operational costs and reduced carbon footprints, making them more appealing to both consumers and businesses.

Urbanization and Infrastructure Development

Rapid urbanization in the GCC is driving the need for enhanced infrastructure, including the electric vehicle-ev-charging-infrastructure market. As cities expand and populations grow, the demand for efficient transportation solutions increases. Urban planners are recognizing the importance of integrating EV charging stations into new developments and existing urban areas. This trend is reflected in various GCC cities, where initiatives are underway to incorporate charging infrastructure into public spaces, commercial centers, and residential complexes. The electric vehicle-ev-charging-infrastructure market must respond to these urbanization trends by ensuring that charging facilities are strategically located to meet the needs of urban dwellers, thereby facilitating the adoption of electric vehicles.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are a crucial driver for the electric vehicle-ev-charging-infrastructure market. Innovations such as ultra-fast charging stations and wireless charging technology are enhancing the convenience and efficiency of EV charging. In the GCC, the introduction of smart charging solutions that optimize energy use and reduce costs is gaining traction. These technologies not only improve the user experience but also contribute to the overall efficiency of the electric vehicle ecosystem. As the electric vehicle-ev-charging-infrastructure market evolves, the adoption of cutting-edge technologies will likely play a pivotal role in attracting consumers and businesses to invest in electric mobility.