Emergence of Edge Computing

The application hosting market is being significantly impacted by the emergence of edge computing, which allows data processing to occur closer to the source of data generation. This trend is particularly relevant in the GCC, where the proliferation of IoT devices and smart technologies is driving the need for low-latency applications. By leveraging edge computing, businesses can enhance application performance and reduce response times, which is crucial for sectors such as manufacturing and smart cities. The integration of edge computing into hosting solutions is expected to create new opportunities for service providers, as they adapt their offerings to meet the demands of this evolving landscape. Consequently, the application hosting market is likely to witness an increase in investments aimed at developing edge computing capabilities.

Adoption of Managed Services

The application hosting market is experiencing an increase in the adoption of managed services, as organizations in the GCC seek to offload the complexities of IT management. This trend is driven by the desire for businesses to focus on their core competencies while relying on specialized providers for hosting and maintenance. Managed services offer a range of benefits, including enhanced security, regular updates, and 24/7 support, which are particularly appealing to small and medium-sized enterprises. Recent statistics indicate that the managed services segment within the application hosting market is expected to grow by 20% over the next few years. This growth reflects a broader shift towards outsourcing IT functions, allowing businesses to leverage the expertise of service providers while optimizing operational efficiency.

Growing Demand for Scalable Solutions

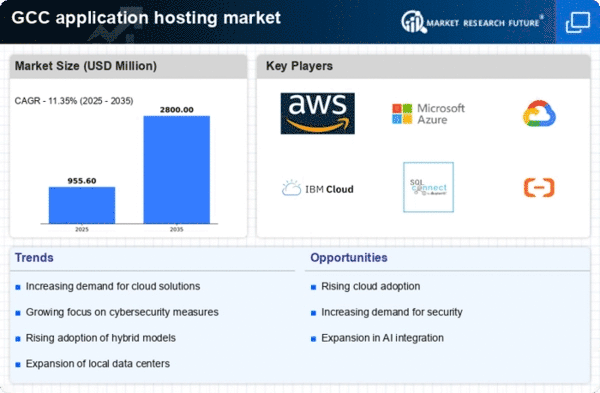

The application hosting market is experiencing a notable surge in demand for scalable solutions, driven by the need for businesses in the GCC to adapt to fluctuating workloads. Organizations are increasingly seeking hosting services that can easily scale resources up or down based on their operational requirements. This trend is particularly evident in sectors such as e-commerce and finance, where traffic can vary significantly. According to recent data, the market for scalable hosting solutions is projected to grow at a CAGR of 15% over the next five years. This growth reflects a broader shift towards flexible IT infrastructures, enabling companies to optimize costs while maintaining performance. As a result, service providers in the application hosting market are investing in technologies that facilitate rapid scaling, thereby enhancing their competitive edge.

Increased Focus on Compliance and Regulations

In the GCC, the application hosting market is increasingly influenced by stringent compliance and regulatory requirements. Organizations are compelled to adhere to local and international standards, such as data protection laws and industry-specific regulations. This has led to a heightened demand for hosting services that ensure compliance, particularly in sectors like healthcare and finance. Service providers are responding by implementing robust compliance frameworks and offering specialized hosting solutions that meet these regulatory demands. The market is witnessing a shift towards providers that can demonstrate their ability to maintain compliance, which is becoming a key differentiator. As a result, the application hosting market is likely to see a rise in partnerships between hosting companies and compliance experts to enhance service offerings.

Rising Importance of Disaster Recovery Solutions

In the GCC, The application hosting market is recognizing the critical importance of disaster recovery solutions. As businesses become more reliant on digital operations, the potential impact of data loss or downtime has become a pressing concern. Organizations are actively seeking hosting providers that offer comprehensive disaster recovery plans to ensure business continuity in the event of unforeseen disruptions. This trend is underscored by a growing awareness of the financial implications of downtime, which can reach thousands of dollars per hour. Consequently, service providers are enhancing their disaster recovery offerings, incorporating advanced technologies such as automated backups and failover systems. This focus on disaster recovery is likely to drive growth in the application hosting market, as businesses prioritize resilience and reliability in their IT strategies.