Advancements in Connectivity Technologies

The agile iot market is being propelled by advancements in connectivity technologies, such as 5G and LPWAN (Low Power Wide Area Network). These technologies enable faster and more reliable communication between devices, which is essential for the effective deployment of agile iot solutions. In the GCC, the rollout of 5G networks is expected to enhance the capabilities of the agile iot market, allowing for greater data transmission speeds and lower latency. This technological evolution is anticipated to drive market growth by facilitating the development of innovative applications across various sectors, including healthcare, transportation, and manufacturing. As connectivity improves, the agile iot market is likely to expand its reach and impact.

Rising Demand for Real-Time Data Processing

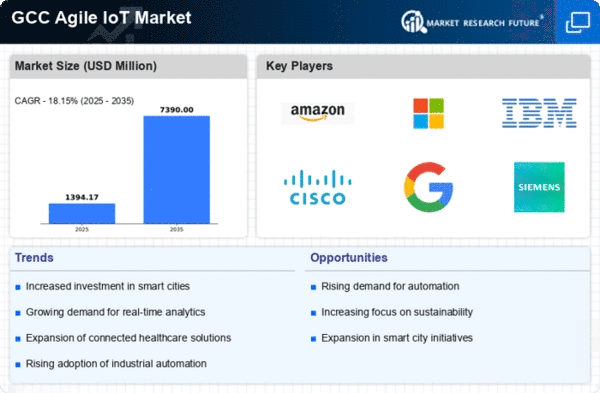

The agile iot market is experiencing a notable surge in demand for real-time data processing capabilities. This trend is driven by the increasing need for businesses in the GCC to make swift, informed decisions based on live data. As organizations seek to enhance operational efficiency, the ability to process and analyze data in real-time becomes crucial. According to recent estimates, the agile iot market in the GCC is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the market's potential to transform industries by enabling immediate insights and actions, thereby fostering a more responsive business environment.

Expansion of Smart Infrastructure Initiatives

The agile iot market is significantly influenced by the expansion of smart infrastructure initiatives across the GCC. Governments in the region are investing heavily in smart city projects, which integrate advanced technologies to improve urban living. This investment is expected to reach $100 billion by 2030, creating a robust demand for agile iot solutions that facilitate connectivity and automation. The agile iot market is poised to benefit from these initiatives, as they require seamless integration of devices and systems to enhance efficiency and sustainability. Consequently, the market is likely to see increased collaboration between public and private sectors to develop innovative solutions that address urban challenges.

Increased Investment in Cybersecurity Solutions

As the agile iot market continues to grow, the importance of cybersecurity has become increasingly apparent. Organizations in the GCC are recognizing the need to protect their data and systems from potential threats. This has led to a surge in investment in cybersecurity solutions tailored for agile iot applications. The market for cybersecurity in the agile iot sector is projected to grow by approximately 30% over the next few years. This focus on security not only safeguards sensitive information but also builds consumer trust, which is essential for the widespread adoption of agile iot technologies. Consequently, the agile iot market is likely to see enhanced security measures as a fundamental component of its growth strategy.

Growing Focus on Sustainability and Energy Efficiency

Sustainability has emerged as a pivotal driver for the agile iot market, particularly in the GCC, where energy consumption is a pressing concern. Organizations are increasingly adopting agile iot solutions to monitor and optimize energy usage, thereby reducing their carbon footprint. The agile iot market is expected to witness a growth rate of around 20% as companies implement smart energy management systems. These systems leverage real-time data to enhance energy efficiency, aligning with regional sustainability goals. As businesses strive to meet regulatory requirements and consumer expectations for environmentally friendly practices, the agile iot market is likely to play a crucial role in facilitating these transitions.