Top Industry Leaders in the Gasoline Direct Injection Market

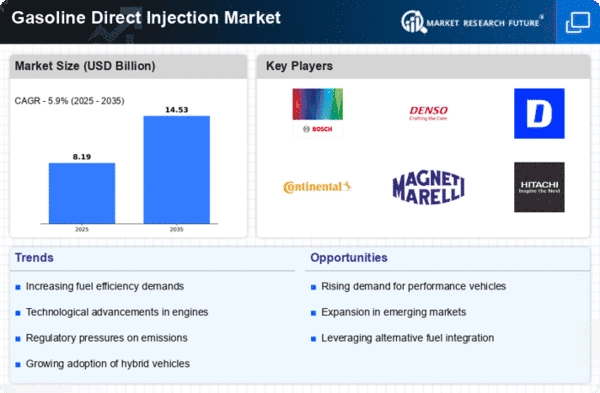

The global Gasoline Direct Injection (GDI) market is poised for substantial growth in the forthcoming years, fueled by factors such as stringent emission regulations, amplified demands for fuel efficiency, and the trend of downsizing engines. Within this promising landscape, the competitive scenario intensifies as established entities and new contenders strive for preeminence in this evolving sector.

Key Players and Strategies: Industry leaders including Bosch, Contential, Delphi, Denso, Magneti Marelli, Hitachi, Stanadyne, MSR-Jebsen Technologies, Eaton Corporation, Mitsubishi Electric Corp., and others shape the GDI market.

Tier 1 Suppliers: Dominating the market are Bosch, Continental, Denso, Delphi Technologies, Magneti Marelli, and Siemens VDO, offering comprehensive GDI system solutions. Their strategies focus on continuous research and development to enhance fuel efficiency and emission control, geographical expansion, and strategic partnerships with emerging technology players for AI-powered engine management.

Tier 2 Suppliers: Smaller entities like Aisin Seiki, BorgWarner, Eaton Corporation, and Johnson Controls specialize in particular components within the GDI system such as fuel injectors, pumps, and sensors. They compete on factors like cost-effectiveness, customization, and niche market specialization. Some are collaborating with Tier 1 suppliers to access larger markets and leverage their expertise.

Emerging Players: Startups and tech companies enter the fray with innovative GDI solutions like multi-stage injection systems, piezo injectors, and AI-based fuel management algorithms. Targeting specific segments like high-performance or luxury vehicles, they collaborate with smaller automakers for initial adoption.

Factors for Market Share Analysis: Determining market share involves evaluating factors such as technology leadership, geographical presence, cost competitiveness, and customer relationships. Companies excelling in advanced GDI technology, delivering superior fuel efficiency, emission reduction, and engine performance, hold a significant competitive edge. Strong presence in key automotive markets like China, Europe, and North America, supported by efficient production and distribution networks, is pivotal for capturing market share. Optimizing production processes, sourcing strategies, and economies of scale are vital for providing cost-effective GDI solutions and attracting budget-conscious automakers. Building strong relationships with automakers through technical collaboration, customized solutions, and aftermarket support fosters loyalty and repeat business.

New and Emerging Trends: Amidst the rise of hybrid and electric vehicles, GDI manufacturers adapt their technology to optimize fuel efficiency in hybrid engines and enhance the range in electric vehicles with range extender engines. Integrating GDI systems with sensors and AI-powered engine management systems allows real-time fuel optimization, predictive maintenance, and personalized driving experiences. Additionally, research and development efforts are underway to adapt GDI systems for biofuels and hydrogen, anticipating future shifts in fuel preferences and regulations.

Overall Competitive Scenario: The GDI market witnesses intense competition with Tier 1 suppliers currently leading. However, Tier 2 suppliers and emerging players are progressively chipping away at market share through niche specialties and innovative solutions. Collaborations and partnerships are increasingly common, fostering technology transfer and accelerating market growth. The focus is shifting towards advanced GDI systems that integrate with electrification trends, preparing for the future of mobility. Success in this market hinges on a combination of technological prowess, cost competitiveness, strategic partnerships, and adaptability to the evolving automotive landscape.

Industry Developments and Latest Updates: Here are the latest updates and developments from key players in the GDI market:

Bosch:

- Announced the launch of its fifth generation of GDI injectors featuring improved spray patterns and reduced emissions, designed for higher injection pressures and a wider range of fuels.

Continental:

- Showcased its latest GDI technology at the SAE International Powertrains & Transportation Systems Conference, focusing on efficiency and emission reduction with systems employing multi-hole injectors and piezo actuators.

Delphi:

- Highlighted its strong position in the GDI market, focusing on cost-effective and fuel-efficient solutions for automakers, with investments in GDI technology featuring increased injector flow rates and improved spray characteristics.

Denso:

- Published a research paper on its development of a high-pressure GDI system for improved engine performance and fuel economy, focusing on reduced noise and vibration and compatibility with alternative fuels.

Magneti Marelli:

- Announced a partnership with a Chinese automaker to supply GDI systems for its new line of fuel-efficient vehicles, emphasizing systems with integrated sensors and control units for improved engine management.

Hitachi:

- Launched its new GDI system with a compact and lightweight design, aiming for improved fuel efficiency and packaging space, while developing systems with variable spray patterns for optimal combustion under various driving conditions.

Stanadyne:

- Expanded into the GDI market with its new line of high-performance injectors, targeting heavy-duty vehicles and off-highway applications.