E-commerce Growth

The rise of e-commerce is a defining factor in the Global furniture Market Industry. Online shopping platforms have revolutionized how consumers purchase furniture, providing convenience and a broader selection. In 2024, the market's value is projected at 540.2 USD Billion, with a significant portion attributed to online sales channels. This shift has prompted traditional retailers to enhance their online presence and invest in digital marketing strategies. As e-commerce continues to expand, it is likely to drive competition and innovation within the Global Furniture Market Industry, leading to a more dynamic marketplace.

Rising Urbanization

The Global Furniture Market Industry appears to be significantly influenced by the ongoing trend of urbanization. As more individuals migrate to urban areas, the demand for residential and commercial furniture increases. In 2024, the market is projected to reach 540.2 USD Billion, driven by the need for space-efficient and aesthetically pleasing furniture solutions. Urban dwellers often seek modern designs that complement smaller living spaces, leading to a surge in demand for multifunctional furniture. This trend is likely to continue, as urban populations are expected to grow, further propelling the Global Furniture Market Industry.

Sustainability Trends

Sustainability has emerged as a pivotal driver within the Global Furniture Market Industry. Consumers increasingly prefer eco-friendly materials and sustainable production practices, which are reshaping purchasing behaviors. Furniture Market manufacturers are responding by incorporating recycled materials and sustainable sourcing into their product lines. This shift not only meets consumer demand but also aligns with global environmental goals. As a result, companies that prioritize sustainability may experience enhanced brand loyalty and market share. The Global Furniture Market Industry is likely to see a notable increase in sustainable product offerings, reflecting a broader commitment to environmental stewardship.

Market Growth Forecast

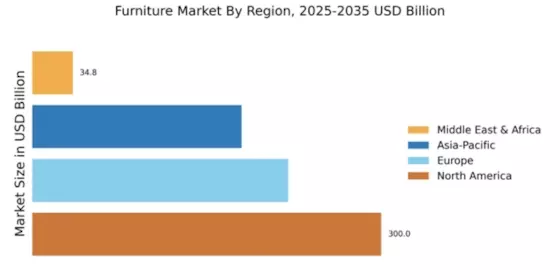

The Global Furniture Market Industry is projected to experience steady growth, with a compound annual growth rate (CAGR) of 2.38% anticipated from 2025 to 2035. This growth trajectory suggests a robust demand for furniture across various segments, including residential, commercial, and office spaces. As the market evolves, factors such as urbanization, sustainability, and technological advancements will likely play crucial roles in shaping its future. The forecasted market value of 700 USD Billion by 2035 indicates a promising outlook, reflecting the industry's resilience and adaptability in a changing global landscape.

Technological Advancements

Technological innovations are reshaping the Global Furniture Market Industry, enhancing both production processes and consumer experiences. Automation and smart manufacturing techniques are streamlining operations, reducing costs, and improving product quality. Additionally, augmented reality and virtual reality technologies are transforming how consumers shop for furniture, allowing them to visualize products in their spaces before purchase. This integration of technology is expected to attract a tech-savvy consumer base, thereby expanding market reach. As the industry adapts to these advancements, the Global Furniture Market Industry is poised for growth, potentially reaching 700 USD Billion by 2035.

Changing Consumer Preferences

Consumer preferences are evolving, significantly impacting the Global Furniture Market Industry. Today's consumers prioritize personalization, quality, and unique design elements in their furniture choices. This shift is prompting manufacturers to offer customizable options and limited-edition collections, catering to diverse tastes. Additionally, the trend towards minimalism and multifunctional furniture reflects a desire for practicality and aesthetic appeal. As these preferences continue to shape the market landscape, the Global Furniture Market Industry is likely to adapt, fostering innovation and creativity in product offerings.