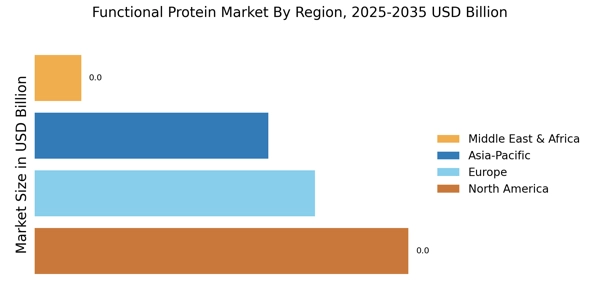

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The European Functional Protein Market accounted for USD 0.025 billion in 2022 and will likely exhibit significant CAGR growth over the study period. Growing geriatric populations, supportive government regulations, and increased awareness of diet and healthy eating practices contribute to this region's growth. The presence of major market players within the region, higher disposable income, changing lifestyles, and increased cases of diseases linked to a sedentary lifestyle have all increased the demand for functional proteins.

Whey protein concentrates are gaining popularity in the region as consumers turn to dairy proteins to meet their nutritional needs.

Further, the major countries studied in the market report are the U.S., Germany, Canada, France, the UK, Spain, Italy, Japan, India, Australia, China, South Korea, and Brazil.

The North American functional protein market holds the second-largest market share owing to changes in lifestyle habits, an unbalanced diet, and improved research and development to create new forms of functional plant-protein-enriched products. The regional market for plant-based functional protein has been made possible by consumer demand for processed and low-cholesterol foods. Nowadays, North American consumers are shifting to alternative products such as green-label food products, which, combined with rising awareness of healthy and plant-based products, is propelling the functional protein forward.

Further, the U.S. functional protein industry held the largest market revenue share, and the Mexico market of functional protein was the fastest-growing market in the North American region.

The Asia-Pacific Functional Protein Market is expected to grow at the fastest CAGR from 2022 to 2030. The growing popularity of functional food and nutritional supplements has led to a significant increase in the consumption of plant-based proteins like soy and pea protein in the Asia Pacific region in recent years. In addition to rising demand from population growth, market growth in Asia Pacific is driven by socioeconomic changes such as increasing disposable incomes, increased spending capacity, aging populations, and increased urbanization.

A new trend developing in the region is the awareness of the significance of protein in a healthy diet. Transformation in dietary patterns in low and middle-income families in developing countries can be seen as indicators of the region's economic development. This trend is expected to encourage dietary supplement manufacturers to locate regional production facilities, opening new functional protein industry opportunities. Moreover, China’s functional protein held the largest market share, and the Indian functional protein industry was the fastest-growing market in the Asia-Pacific region.