Fuel Convenience Store Pos Size

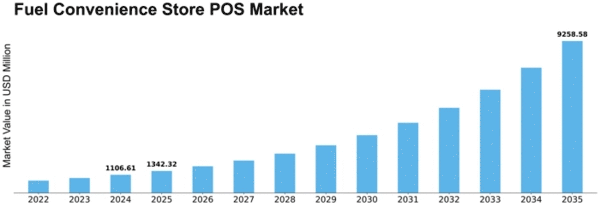

Fuel Convenience Store POS Market Growth Projections and Opportunities

The market dynamics of the Fuel Convenience Store Point of Sale (POS) market are characterized by a combination of various factors that influence its growth and evolution. As technology continues to advance, the Fuel Convenience Store POS market is experiencing a significant transformation. The increasing demand for streamlined and efficient operations in fuel convenience stores has led to a surge in the adoption of POS systems tailored to meet the unique needs of this sector.

One key driving force behind the market dynamics is the growing emphasis on automation and digitalization within the fuel retail industry. Fuel convenience stores are increasingly recognizing the importance of POS systems that not only handle transactions but also offer inventory management, employee tracking, and real-time reporting capabilities. As a result, there is a rising trend of fuel convenience stores upgrading their traditional cash registers to more sophisticated POS solutions, contributing to market expansion.

Moreover, the integration of contactless payment technologies and mobile POS solutions has become a pivotal factor shaping the market dynamics. With the global shift towards digital and mobile payments, fuel convenience stores are adapting their POS systems to accommodate these preferences. Customers are now seeking faster and more convenient payment options, and POS systems are evolving to meet these expectations. The market is witnessing a surge in the development of POS solutions that seamlessly integrate with mobile payment platforms, enhancing the overall customer experience.

Additionally, regulatory changes and compliance requirements play a crucial role in shaping the market dynamics of the Fuel Convenience Store POS market. Governments and regulatory bodies are increasingly implementing stringent rules and standards related to payment processing, data security, and compliance reporting. Fuel convenience stores need to ensure that their POS systems adhere to these regulations, driving the demand for advanced and compliant POS solutions. As a result, POS vendors are continually innovating to provide systems that not only meet current standards but also anticipate future regulatory changes.

The competitive landscape is another significant aspect of the market dynamics. As more players enter the Fuel Convenience Store POS market, competition intensifies, leading to innovations and improvements in POS technology. Vendors are striving to differentiate their offerings by providing additional features such as loyalty programs, customer relationship management (CRM) capabilities, and analytics tools. This competitive environment fosters a continuous cycle of development, pushing the market towards enhanced functionalities and improved user experiences.

The ongoing digital transformation and the increasing importance of data analytics are also influencing the market dynamics. Fuel convenience stores are leveraging POS systems that offer advanced analytics and reporting capabilities. These tools empower retailers to gather valuable insights into customer behavior, inventory trends, and sales patterns. The ability to make data-driven decisions enhances operational efficiency and helps fuel convenience stores stay competitive in a rapidly evolving market.

Leave a Comment