Top Industry Leaders in the FSRU Market

*Disclaimer: List of key companies in no particular order

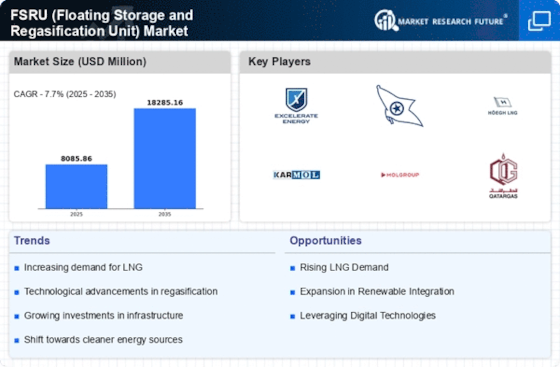

The Floating Storage and Regasification Unit (FSRU) market, a burgeoning sector within the Liquefied Natural Gas (LNG) industry, exhibits dynamism and growth. FSRUs are increasingly sought-after solutions worldwide, given the rising global demand for natural gas and the quest for adaptable, cost-efficient energy alternatives.Key Players and Market Share:A few established entities dominate the FSRU market, with the top five companies commanding over 80% of the global share:- Excelerate Energy- Hoegh LNG- Golar LNG- BW gas- Gazprom FLEX LNG- Exmar- Maran Gas Maritime Inc.- Offshore LNG Toscana SpA- Mitsui O.S.K. Lines- Bumi Armada- Teekay Lng Partners, L.P, among others.- Höegh LNG: A Norwegian company excelling in the FSRU market, operating several FSRUs globally.- Excelerate Energy: A US-based entity boasting a large FSRU fleet, emphasizing short-term charters and floating LNG infrastructure solutions.- Golar LNG: A Norwegian LNG shipping and storage company with diverse FSRU and LNG carrier fleets.- BW Gas: A Singapore-based shipping firm strengthening its presence in the FSRU market, emphasizing longer-term contracts.- MOL: A Japanese shipping and logistics enterprise expanding its FSRU fleet and focusing on the Asian market.Key Player Strategies:FSRU market leaders employ various strategies to sustain their competitive edge:- Fleet Expansion and Modernization: Investment in new FSRU vessels to bolster capacity and meet escalating demand.- Geographical Diversification: Expanding into new regions with high FSRU utilization potential.- Strategic Partnerships: Collaborating with other entities to leverage combined expertise and resources.- Focus on Technology and Innovation: Development and implementation of new technologies enhancing efficiency, safety, and environmental performance.- Transition to Longer-Term Contracts: Shifting from short-term charters to secure more stable and predictable revenue streams.Factors for Market Share Analysis:Several factors influence market share in the FSRU market:- Number of Operated FSRUs: A gauge of a company's capacity and market outreach.- Total Storage Capacity: Reflects an entity's LNG storage and regasification capability.- Charter Rates: High rates signify robust FSRU demand, potentially translating to increased profitability.- Geographical Presence: Operating in pivotal growth markets offers a competitive edge.- Experience and Expertise: A long-standing history in the FSRU domain often implies reliability and trustworthiness.New and Emerging Trends:Evolving trends significantly shape the competitive landscape of the FSRU market:- Surge in Small-Scale FSRUs: Increasing popularity of smaller FSRUs due to their cost-effectiveness and suitability for smaller markets.- Emphasis on Operational Efficiency: Investment in technology and software optimizing FSRU operations and reducing expenses.- FSRU Bunkering Services Development: Providing FSRUs with LNG bunkering capabilities becomes crucial for emissions reduction and environmental compliance.- Elevated Focus on Environmental Sustainability: Exploration of means to minimize the environmental impact of FSRU operations, including the use of cleaner fuels and emission-cutting technologies.- Escalating Demand for Integrated LNG Solutions: Heightened customer interest in integrated solutions encompassing FSRUs, LNG carriers, and onshore regasification terminals.Overall Competitive Scenario:Anticipated growth in the FSRU market, driven by surging natural gas demand and the pursuit of adaptable, cost-efficient solutions, is poised to intensify competition among existing entities and foster new entrants. Entities adept at adapting to evolving dynamics, embracing cutting-edge technologies and market trends, are better positioned for success in the competitive FSRU landscape.Additional Considerations:- Regulatory Influence: Governmental policies and incentives play a pivotal role in the FSRU market's development, attracting investment and fostering growth.- Financing Availability: Securing funding remains critical for FSRU projects to invest in new vessels and infrastructure.- Technological Disruption: Advancements like floating LNG liquefaction and storage solutions could disrupt the current market landscape.Developments and Latest Updates:- Excelerate Energy completed its LNG regasification terminal expansion in Bangladesh in September 2023.- Golar LNG secured a multi-year charter contract for its "Golar Nanook" FSRU with RWE in Germany in September 2023.- BW Gas signed a joint venture agreement with PETRONAS for FSRU projects in Southeast Asia in December 2023.- Gazprom FLEX LNG announced plans to acquire two additional FSRUs in November 2023.- Maran Gas Maritime Inc. secured a multi-year charter contract for its "MGT Gimi" FSRU with Engie in Greece in November 2023.