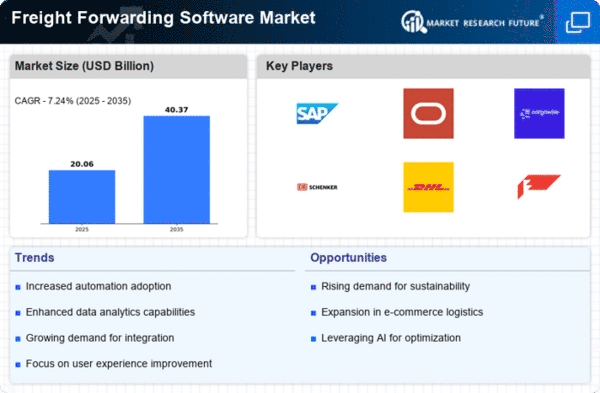

The Freight Forwarding Software Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for efficient logistics solutions and the ongoing digital transformation across the supply chain. Major players such as SAP (DE), Oracle (US), and Cargowise (AU) are strategically positioning themselves through innovation and partnerships, which collectively shape the competitive environment. SAP (DE) focuses on integrating advanced analytics and AI capabilities into its software solutions, enhancing operational efficiency for clients. Meanwhile, Oracle (US) emphasizes cloud-based solutions, allowing for greater scalability and flexibility in freight management. Cargowise (AU) is leveraging its global network to provide comprehensive visibility and control over logistics operations, which is increasingly vital in today's fast-paced market.The business tactics employed by these companies include optimizing supply chains and localizing services to meet regional demands. The market structure appears moderately fragmented, with a mix of established players and emerging startups. This fragmentation allows for diverse offerings, yet the collective influence of key players like DHL (DE) and Kuehne + Nagel (CH) remains significant, as they continue to set benchmarks in service quality and technological integration.

In November DHL (DE) announced a strategic partnership with a leading AI firm to enhance its freight forwarding software capabilities. This collaboration aims to integrate machine learning algorithms that predict shipment delays and optimize routing, thereby improving customer satisfaction and operational efficiency. Such a move underscores DHL's commitment to leveraging technology to maintain its competitive edge in the market.

In October Kuehne + Nagel (CH) launched a new digital platform designed to streamline the booking process for freight services. This platform not only simplifies user experience but also incorporates real-time tracking features, which are increasingly demanded by customers. The introduction of this platform reflects Kuehne + Nagel's focus on digital transformation and its intent to enhance customer engagement through innovative solutions.

In September Expeditors (US) expanded its service offerings by acquiring a regional logistics provider in Southeast Asia. This acquisition is expected to bolster Expeditors' presence in a rapidly growing market, allowing for improved service delivery and enhanced operational capabilities. Such strategic moves indicate a trend towards consolidation in the industry, as companies seek to expand their geographical reach and service portfolios.

As of December the competitive trends in the Freight Forwarding Software Market are increasingly defined by digitalization, sustainability initiatives, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability, as firms strive to meet the evolving demands of their customers.