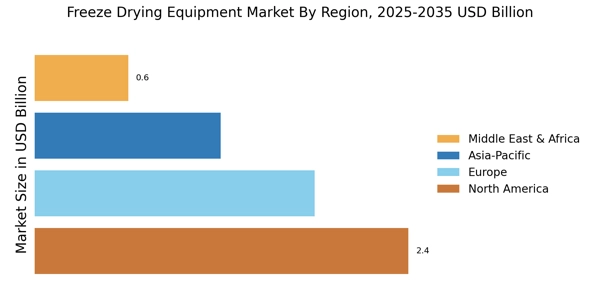

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America Freeze Drying Equipment Market accounted for USD 2.079 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. This is attributed to the Customer requirements in the food & beverage industry are defined by dynamic trends in commercial freeze dryer costs, food preferences, food safety, and security issues.

These requirements are changing F&B manufacturers' processing and supply chain models, augmenting the demand for commercial freeze drying equipment, enabling market interruptions such as product differentiation, consolidation, and a greater emphasis on food safety and security, thereby driving the market growth.

For instance, in 2022, the U.S. pharmaceutical industry's output and sales will be driven by the ongoing vaccination campaign and unmet demand for both necessary and optional medical treatments. This will also boost the market for freeze dry equipment.

Further, the major countries studied in the market report are The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Freeze Drying Equipment Market accounts for the second-largest market share due to the Increased R&D investments, increasing healthcare spending, and the emergence of biologics & biosimilars. According to the EU, France (12.2%) and Germany (12.8%) had the greatest healthcare spending relative to GDP in 2020 among EU Member States.

Moreover, the presence of a favorable regulatory environment and reimbursement policies is projected to promote pharmaceutical product demand in this area, helping the expansion of the market of equipment to freeze dry food. Further, the Germany Freeze Drying Equipment Market held the largest market share, and the UK Freeze Drying Equipment Market was the fastest growing market in the European region

The Asia-Pacific Freeze Drying Equipment Market is expected to grow at the fastest CAGR from 2022 to 2030. This is due to the presence of major pharmaceutical industries in the region such as Livzon Pharmaceutical Group, Guangzhou Baiyunshan Pharmaceutical Holdings, and freeze drying equipment manufacturers India, including Dr. Reddy's Laboratories, Ltd. drives the pharmaceutical industry. These companies use freeze-drying technology to keep biological products such as biological fluids, medicines, proteins, enzymes, and hormones safe.

Freeze dryers extend the shelf-life of a live viral vaccine, which is in high demand by pharmaceutical companies, especially post-COVID-19. Moreover, China Freeze Drying Equipment Market held the largest market share, and the India Freeze Drying Equipment Market was the fastest growing market in the Asia-Pacific region.