Rising Cybersecurity Concerns

In the context of the France Virtual Desktop Market, cybersecurity remains a paramount concern for organizations. With the increasing frequency of cyberattacks, businesses are prioritizing the protection of sensitive data. The French government has implemented stringent regulations regarding data protection, which has compelled companies to invest in secure virtual desktop solutions. Recent statistics indicate that over 70% of French enterprises consider cybersecurity a critical factor when selecting IT infrastructure. This heightened awareness is driving the adoption of virtual desktops, as they offer enhanced security features such as centralized management and data encryption. Consequently, the market is likely to witness growth as organizations seek to mitigate risks associated with data breaches and ensure compliance with regulatory standards.

Increased Focus on Cost Efficiency

Cost efficiency is a driving factor in the France Virtual Desktop Market, as organizations seek to optimize their IT expenditures. Virtual desktop solutions can significantly reduce hardware costs and maintenance expenses, making them an attractive option for businesses. Recent analyses indicate that companies can save up to 30% on IT costs by transitioning to virtual desktops. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) in France, which often operate with limited budgets. Additionally, the ability to centralize IT management and reduce the need for on-site infrastructure contributes to overall cost savings. As organizations continue to prioritize financial prudence, the demand for virtual desktop solutions is expected to rise, further propelling market growth.

Regulatory Compliance and Data Sovereignty

The France Virtual Desktop Market is also shaped by regulatory compliance and data sovereignty concerns. French laws mandate that certain types of data must be stored within national borders, which influences the choice of virtual desktop solutions. Organizations are increasingly seeking providers that can ensure compliance with local regulations while offering robust data protection. The French government has established clear guidelines regarding data handling, which has led to a growing preference for virtual desktop solutions that adhere to these standards. As businesses navigate the complexities of regulatory compliance, the demand for compliant virtual desktop solutions is likely to increase, thereby driving market growth. This trend underscores the importance of aligning virtual desktop offerings with the legal landscape in France.

Advancements in Cloud Computing Technologies

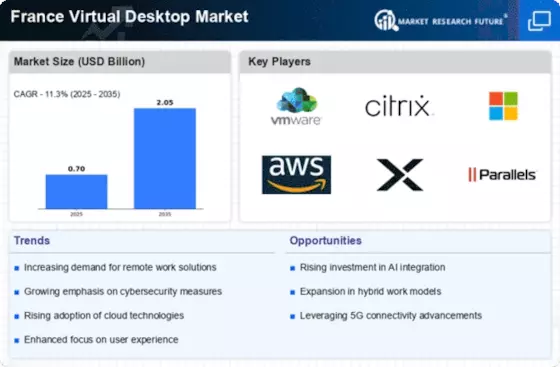

The France Virtual Desktop Market is significantly influenced by advancements in cloud computing technologies. The proliferation of cloud services has enabled organizations to deploy virtual desktops more efficiently and cost-effectively. Recent reports suggest that the cloud computing market in France is projected to grow at a compound annual growth rate of 15% over the next five years. This growth is likely to bolster the virtual desktop market, as businesses increasingly leverage cloud-based solutions for scalability and flexibility. Moreover, the integration of cloud technologies allows for seamless updates and maintenance, reducing the burden on IT departments. As a result, organizations are more inclined to adopt virtual desktop solutions that align with their cloud strategies, further driving market expansion.

Growing Demand for Flexible Work Environments

The France Virtual Desktop Market is experiencing a notable increase in demand for flexible work environments. Organizations are increasingly adopting virtual desktop solutions to facilitate remote work and enhance employee productivity. According to recent data, approximately 60% of French companies have implemented some form of remote work policy, which has driven the need for virtual desktop infrastructure. This shift allows employees to access their work environments from various locations, thereby improving work-life balance and job satisfaction. Furthermore, the French government has been supportive of remote work initiatives, providing guidelines and incentives for businesses to adopt digital solutions. As a result, the market for virtual desktops is likely to expand, catering to the evolving needs of the workforce.