Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats in France is a primary driver for the unified threat-management market. Organizations are facing a myriad of challenges, including ransomware attacks, phishing schemes, and data breaches. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, with a significant portion of this impact felt in France. As a result, companies are compelled to invest in comprehensive security solutions that can address these threats effectively. The unified threat-management market is positioned to benefit from this trend, as it offers integrated solutions that combine multiple security features into a single platform, thereby enhancing the overall security posture of organizations. This growing awareness of cybersecurity risks is likely to propel the demand for unified threat-management solutions across various sectors in France.

Emergence of Remote Work Culture

The rise of remote work in France is reshaping the landscape of the unified threat-management market. As more organizations adopt flexible work arrangements, the attack surface for cyber threats expands, necessitating enhanced security measures. In 2025, it is estimated that over 50% of the workforce in France will engage in remote work at least part-time. This shift creates a pressing need for unified threat-management solutions that can secure remote access to corporate networks and protect sensitive information from potential breaches. Organizations are increasingly looking for solutions that provide visibility and control over remote endpoints, ensuring that employees can work securely from any location. Consequently, the unified threat-management market is likely to experience growth as businesses seek to implement comprehensive security strategies that address the challenges posed by a distributed workforce.

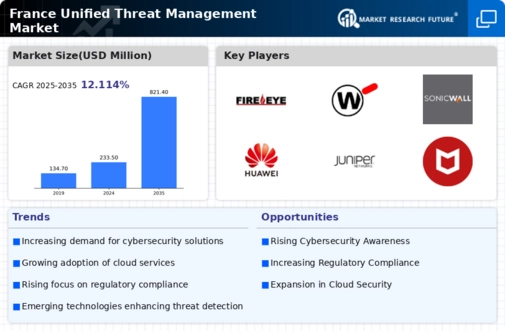

Increased Adoption of Cloud Services

The shift towards cloud computing in France is significantly influencing the unified threat-management market. As businesses increasingly migrate their operations to the cloud, the need for robust security measures becomes paramount. According to recent data, approximately 70% of French enterprises are expected to adopt cloud services by the end of 2025. This transition necessitates the implementation of unified threat-management solutions that can provide comprehensive security across hybrid and multi-cloud environments. These solutions are designed to protect sensitive data and applications hosted in the cloud, ensuring compliance with local regulations and safeguarding against potential threats. The unified threat-management market is thus likely to experience substantial growth as organizations seek to secure their cloud infrastructures and maintain business continuity in an evolving digital landscape.

Growing Demand for Integrated Security Solutions

The unified threat-management market is witnessing a surge in demand for integrated security solutions among French enterprises. Organizations are increasingly recognizing the limitations of traditional security measures, which often operate in silos. In 2025, it is projected that the market for integrated security solutions will grow by over 25% in France, driven by the need for a cohesive approach to cybersecurity. Unified threat-management solutions offer a comprehensive suite of security features, including firewall, intrusion detection, and antivirus capabilities, all within a single platform. This integration not only simplifies security management but also enhances the effectiveness of threat detection and response. As businesses strive to streamline their security operations and reduce complexity, the appeal of unified threat-management solutions is likely to strengthen, further propelling market growth.

Regulatory Pressures and Compliance Requirements

In France, the evolving regulatory landscape is a significant driver for the unified threat-management market. With stringent data protection laws such as the General Data Protection Regulation (GDPR) in place, organizations are under increasing pressure to ensure compliance. Failure to adhere to these regulations can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory environment compels businesses to invest in unified threat-management solutions that not only protect sensitive data but also facilitate compliance with legal requirements. As organizations seek to mitigate risks associated with non-compliance, the demand for integrated security solutions that can demonstrate adherence to regulatory standards is likely to rise, thereby boosting the unified threat-management market in France.