Advancements in Imaging Technologies

Innovations in imaging technologies are transforming the interventional radiology-products market. Enhanced imaging modalities, such as MRI, CT, and ultrasound, provide real-time visualization, which is crucial for successful interventions. These advancements facilitate more accurate diagnoses and treatment planning, leading to improved patient safety and outcomes. In France, the integration of advanced imaging techniques has been linked to a 30% increase in the efficiency of interventional procedures. As healthcare facilities adopt these technologies, the demand for related products is likely to surge, indicating a robust growth trajectory for the market.

Increasing Prevalence of Chronic Diseases

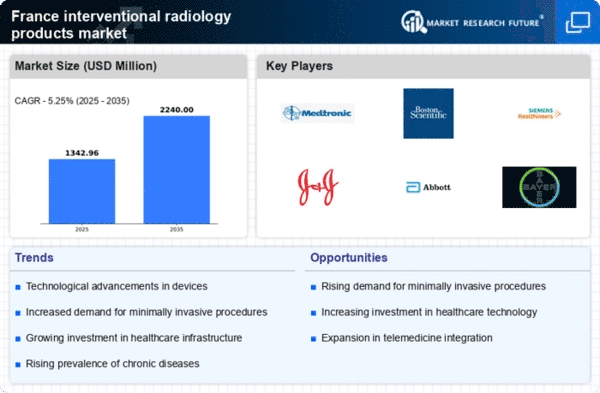

The rising incidence of chronic diseases in France is a pivotal driver for the interventional radiology-products market. Conditions such as cardiovascular diseases, cancer, and diabetes necessitate advanced treatment options. According to recent health statistics, chronic diseases account for approximately 70% of all deaths in France, highlighting the urgent need for effective medical interventions. Interventional radiology offers minimally invasive solutions that can significantly improve patient outcomes. As the population ages, the demand for innovative products in this sector is expected to grow. This trend suggests that healthcare providers will increasingly rely on interventional radiology to manage chronic conditions, thereby propelling market growth.

Growing Investment in Healthcare Infrastructure

The French government is actively investing in healthcare infrastructure, which is a significant driver for the interventional radiology-products market. Recent initiatives aim to modernize hospitals and expand access to advanced medical technologies. With an estimated budget increase of €2 billion allocated for healthcare improvements, facilities are better equipped to adopt interventional radiology techniques. This investment not only enhances the quality of care but also encourages the adoption of innovative products. As hospitals upgrade their capabilities, the interventional radiology-products market is poised for substantial growth, reflecting the commitment to improving patient care.

Regulatory Support for Innovative Medical Devices

Regulatory bodies in France are providing support for the development and approval of innovative medical devices, which is beneficial for the interventional radiology-products market. Streamlined approval processes and incentives for research and development are encouraging manufacturers to introduce new products. The French National Agency for the Safety of Medicines and Health Products (ANSM) has implemented measures to expedite the evaluation of devices that demonstrate significant clinical benefits. This regulatory environment fosters innovation and enhances market competitiveness, suggesting that the interventional radiology-products market will continue to expand as new technologies are introduced.

Rising Awareness of Minimally Invasive Techniques

There is a growing awareness among both healthcare professionals and patients regarding the benefits of minimally invasive techniques, which is driving the interventional radiology-products market. Patients are increasingly seeking alternatives to traditional surgical procedures due to shorter recovery times and reduced risks. In France, surveys indicate that over 60% of patients prefer minimally invasive options when available. This shift in patient preference is prompting healthcare providers to expand their offerings in interventional radiology. Consequently, the market is likely to experience increased demand for products that facilitate these procedures, aligning with the evolving landscape of patient care.