Growing Data Storage Needs

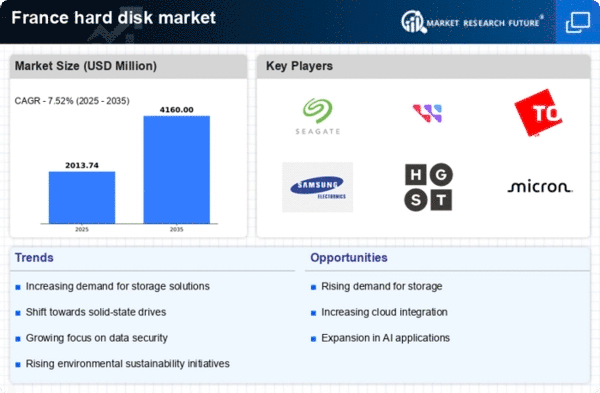

The hard disk market in France is experiencing a notable surge in demand driven by the increasing volume of data generated across various sectors. Businesses are increasingly reliant on data analytics, necessitating robust storage solutions. In 2025, the data generated in France is projected to reach approximately 2.5 zettabytes, indicating a substantial need for high-capacity hard disks. This trend is particularly evident in industries such as finance, healthcare, and e-commerce, where data storage requirements are critical for operational efficiency. As organizations seek to manage and store vast amounts of information, the hard disk market is likely to benefit from this growing demand, leading to innovations in storage technology and competitive pricing strategies.

Increased Focus on Data Security

Data security has become a paramount concern for organizations in France, significantly impacting the hard disk market. With the rise in cyber threats and data breaches, businesses are prioritizing secure storage solutions. In 2025, it is projected that 60% of companies in France will invest in advanced security features for their data storage systems. This trend is driving demand for hard disks equipped with encryption and other security measures. As organizations seek to protect sensitive information, the hard disk market is likely to adapt by offering products that emphasize data protection, thereby enhancing consumer confidence and market growth.

Rising Adoption of Cloud Services

The hard disk market in France is significantly influenced by the increasing adoption of cloud services. As businesses migrate to cloud-based solutions, the demand for reliable and high-performance hard disks remains essential for data centers. In 2025, it is estimated that over 70% of French enterprises will utilize cloud services, necessitating the integration of efficient storage systems. This shift not only enhances data accessibility but also drives the need for advanced hard disk technologies that can support cloud infrastructure. Consequently, the hard disk market is poised for growth as providers focus on developing products that cater to the specific requirements of cloud computing, ensuring data integrity and security.

Sustainability Initiatives in Technology

The hard disk market in France is increasingly influenced by sustainability initiatives as consumers and businesses become more environmentally conscious. In 2025, it is anticipated that 40% of French consumers will prefer eco-friendly technology solutions, including energy-efficient hard disks. Manufacturers are responding by developing products that minimize energy consumption and reduce carbon footprints. This shift towards sustainability not only aligns with consumer preferences but also encourages innovation within the hard disk market. As companies strive to meet regulatory requirements and consumer expectations, the industry is likely to see a rise in the availability of green technology solutions, fostering a more sustainable market landscape.

Technological Advancements in Storage Solutions

The hard disk market in France is witnessing a transformation due to rapid technological advancements. Innovations such as 3D NAND technology and improved data transfer rates are enhancing the performance and reliability of hard disks. In 2025, the introduction of new storage technologies is expected to increase the average data transfer speed by approximately 30%, making hard disks more appealing to consumers and businesses alike. These advancements not only improve user experience but also contribute to the overall growth of the hard disk market. As manufacturers invest in research and development, the industry is likely to see a proliferation of high-performance products that meet the evolving needs of the market.