Increased Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the ethernet phy-chip market. In France, the number of connected devices is expected to reach 1 billion by 2025, creating a substantial demand for efficient networking solutions. Ethernet phy-chips play a vital role in ensuring reliable communication between these devices, facilitating data transfer and connectivity. The growing emphasis on smart homes, industrial automation, and smart cities further propels the need for robust ethernet phy-chips. As the IoT ecosystem expands, the ethernet phy-chip market is likely to see a significant uptick in demand, with manufacturers focusing on developing chips that can handle the unique requirements of diverse IoT applications.

Shift Towards Cloud Computing Solutions

The shift towards cloud computing solutions is reshaping the ethernet phy-chip market landscape. As more businesses in France migrate their operations to the cloud, the demand for high-performance networking components, including ethernet phy-chips, is on the rise. Cloud service providers require reliable and efficient networking solutions to support their infrastructure, which in turn drives the need for advanced ethernet phy-chips. The market for cloud services in France is anticipated to grow by 20% annually, further emphasizing the importance of robust networking solutions. This trend indicates that the ethernet phy-chip market will likely experience sustained growth as organizations seek to optimize their cloud-based operations.

Technological Advancements in Networking

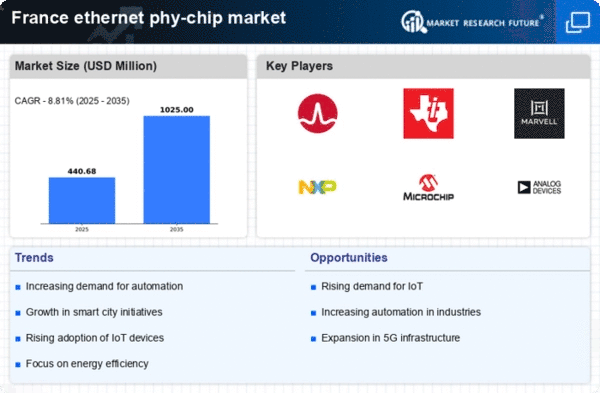

the ethernet phy-chip market is surging due to rapid technological advancements in networking solutions.. Innovations such as 5G and Wi-Fi 6 are driving the demand for high-performance ethernet phy-chips, which are essential for supporting increased data rates and reduced latency. In France, the market for networking equipment is projected to grow at a CAGR of 8.5% from 2025 to 2030, indicating a robust demand for advanced ethernet phy-chips. These chips are crucial for enabling seamless connectivity in various applications, including data centers, enterprise networks, and IoT devices. As businesses and consumers alike seek faster and more reliable internet connections, the ethernet phy-chip market is likely to benefit significantly from these technological trends..

Emergence of Smart Manufacturing Practices

The emergence of smart manufacturing practices is a significant driver for the ethernet phy-chip market. In France, industries are increasingly adopting automation and digitalization to enhance productivity and efficiency. Ethernet phy-chips are integral to the implementation of Industry 4.0 technologies, enabling seamless communication between machines and systems. As manufacturers invest in smart factories, the demand for reliable and high-speed networking solutions is expected to rise. The market for industrial automation in France is projected to grow by 15% over the next five years, indicating a strong potential for the ethernet phy-chip market. This trend suggests that the integration of advanced networking technologies will play a crucial role in the future of manufacturing.

Rising Data Traffic and Bandwidth Requirements

The ethernet phy-chip market is significantly influenced by the rising data traffic and bandwidth requirements across various sectors. In France, data consumption is projected to increase by 30% annually, driven by the growing use of streaming services, cloud computing, and online gaming. This surge in data traffic necessitates the deployment of advanced ethernet phy-chips capable of supporting higher data rates and improved performance. As organizations strive to enhance their network infrastructure to accommodate this growing demand, the ethernet phy-chip market is expected to expand. The need for efficient data handling and transmission solutions will likely lead to increased investments in the development of next-generation ethernet phy-chips.