Increasing Prevalence of Epilepsy

The rising incidence of epilepsy in France is a crucial driver for the epilepsy market. Recent estimates indicate that approximately 600,000 individuals are living with epilepsy in the country, which translates to about 1% of the population. This growing prevalence necessitates enhanced healthcare services and treatment options, thereby stimulating demand within the epilepsy market. Furthermore, as awareness of the condition increases, more individuals are likely to seek medical attention, leading to a higher diagnosis rate. This trend suggests that the market will continue to expand as healthcare providers strive to meet the needs of this growing patient population.

Advancements in Antiepileptic Drugs

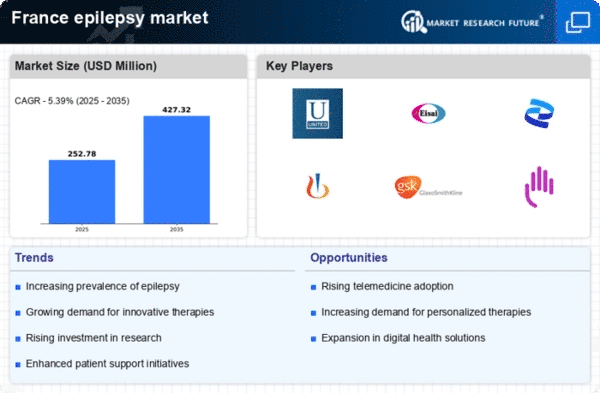

Innovations in the development of antiepileptic drugs (AEDs) are significantly influencing the epilepsy market in France. The introduction of new AEDs, particularly those with improved efficacy and fewer side effects, is likely to enhance treatment outcomes for patients. For instance, the market has seen a surge in the use of novel medications that target specific types of seizures, which may lead to better management of the condition. As of 2025, the market for AEDs is projected to reach approximately €1.5 billion, reflecting a compound annual growth rate (CAGR) of around 5%. This growth underscores the importance of ongoing research and development in the epilepsy market.

Government Funding and Support Programs

Government initiatives and funding aimed at epilepsy research and treatment are vital drivers for the epilepsy market in France. The French government has allocated substantial resources to support research projects focused on understanding epilepsy and developing new therapies. This financial backing is likely to foster innovation within the market, leading to the introduction of advanced treatment options. Furthermore, public health programs designed to improve access to care for individuals with epilepsy are expected to enhance patient outcomes and increase market demand. Such support indicates a commitment to addressing the needs of the epilepsy community.

Technological Innovations in Monitoring

Technological advancements in monitoring and treatment options are reshaping the epilepsy market in France. The emergence of wearable devices and mobile applications designed to track seizure activity is providing patients and healthcare providers with valuable data. These innovations facilitate better management of the condition and enable timely interventions. As technology continues to evolve, it is likely that more patients will adopt these tools, leading to improved treatment adherence and outcomes. The integration of technology into epilepsy care represents a significant opportunity for growth within the epilepsy market.

Rising Awareness and Education Initiatives

In France, increased awareness and educational initiatives regarding epilepsy are pivotal in driving the epilepsy market. Campaigns aimed at educating the public about the condition, its symptoms, and treatment options are gaining traction. These initiatives not only help reduce stigma but also encourage individuals to seek medical advice and treatment. As awareness grows, it is anticipated that more patients will be diagnosed and treated, thereby expanding the market. Additionally, healthcare professionals are increasingly being trained to recognize and manage epilepsy effectively, which further supports the growth of the epilepsy market.