Rising Incidence of Cancer

The increasing incidence of cancer in France is a primary driver for the circulating tumor-cell market. According to recent statistics, cancer cases are projected to rise by approximately 2.5% annually, leading to a heightened demand for advanced diagnostic tools. This trend is particularly evident in urban areas where lifestyle factors contribute to higher cancer rates. As healthcare providers seek more effective methods for early detection and monitoring, the circulating tumor-cell market is likely to experience significant growth. The ability to detect cancer at an earlier stage can potentially improve patient outcomes, thereby driving investments in innovative technologies. Consequently, the market is expected to expand as healthcare systems adapt to the growing need for efficient cancer management solutions.

Regulatory Framework Enhancements

The evolving regulatory landscape in France is playing a crucial role in shaping the circulating tumor-cell market. Recent enhancements in regulatory frameworks are aimed at expediting the approval process for innovative diagnostic tools. This is particularly relevant for liquid biopsy technologies, which are gaining traction due to their non-invasive nature. The French government is actively promoting policies that support the development and commercialization of advanced diagnostic solutions. As a result, the market is expected to witness a surge in new product launches and increased competition among key players. By fostering a conducive environment for innovation, these regulatory changes are likely to drive growth in the circulating tumor-cell market, ultimately benefiting patients through improved diagnostic options.

Advancements in Diagnostic Technologies

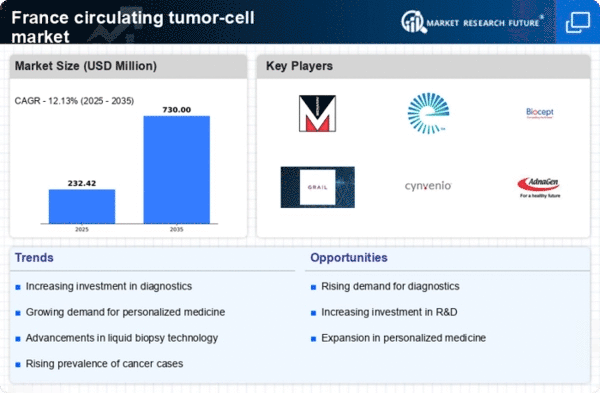

Technological innovations in diagnostic methods are significantly influencing the circulating tumor-cell market. The development of more sensitive and specific assays has enhanced the ability to detect circulating tumor cells in blood samples. For instance, the introduction of microfluidic technologies and next-generation sequencing has improved the accuracy of liquid biopsies. These advancements are crucial as they allow for non-invasive monitoring of cancer progression and treatment response. In France, the market for these technologies is projected to grow by over 15% annually, reflecting the increasing adoption of liquid biopsy techniques in clinical settings. As healthcare providers recognize the benefits of these advanced diagnostic tools, the demand for circulating tumor-cell solutions is expected to rise, further propelling market growth.

Increased Investment in Cancer Research

The circulating tumor-cell market is benefiting from increased investment in cancer research initiatives across France. Government funding and private sector investments are being directed towards innovative cancer therapies and diagnostic solutions. In 2025, it is estimated that research funding for cancer-related projects will exceed €1 billion, with a significant portion allocated to the development of liquid biopsy technologies. This influx of capital is likely to accelerate the pace of innovation within the circulating tumor-cell market, fostering collaborations between academic institutions and industry players. As new discoveries emerge, the market is expected to expand, providing healthcare professionals with advanced tools for cancer detection and management.

Growing Awareness of Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the circulating tumor-cell market. Patients and healthcare providers are increasingly recognizing the importance of tailored treatment approaches based on individual tumor characteristics. This trend is driving demand for circulating tumor-cell technologies that facilitate the identification of specific biomarkers. In France, the market is projected to grow by approximately 12% annually as healthcare systems integrate personalized medicine into standard practice. The ability to customize treatment plans based on circulating tumor-cell analysis not only enhances therapeutic efficacy but also minimizes adverse effects, making it a compelling option for cancer management. As awareness continues to grow, the circulating tumor-cell market is likely to see sustained expansion.