Focus on Financial Inclusion

The France Banking As A Service Market is increasingly prioritizing financial inclusion as a key driver of growth. With a significant portion of the population still lacking access to essential banking services, there is a concerted effort to bridge this gap. Initiatives aimed at providing affordable and accessible financial products are gaining traction, particularly among underserved communities. The French government has launched programs to promote financial literacy and access to banking services, which is likely to enhance participation in the financial system. This focus on inclusion not only addresses social equity but also presents a substantial market opportunity for financial institutions. As banks and fintechs collaborate to create inclusive solutions, the France Banking As A Service Market is poised for expansion.

Regulatory Framework Enhancements

The regulatory landscape surrounding the France Banking As A Service Market is evolving, with authorities implementing frameworks that encourage innovation while ensuring consumer protection. The French government has introduced initiatives aimed at fostering a competitive environment for fintechs and traditional banks alike. For instance, the Autorite de Controle Prudentiel et de Resolution (ACPR) has been proactive in establishing guidelines that facilitate the entry of new players into the market. This regulatory support is likely to stimulate growth within the France Banking As A Service Market, as it provides a structured environment for innovation and collaboration. Enhanced regulations may also lead to increased consumer trust, further propelling market expansion.

Increased Investment in Fintech Startups

Investment in fintech startups is significantly influencing the France Banking As A Service Market. Venture capital funding for fintech companies in France has seen a remarkable increase, with investments reaching over 1 billion euros in recent years. This influx of capital is enabling startups to develop innovative solutions that challenge traditional banking models. As these fintech companies introduce new services, established banks are increasingly seeking partnerships to remain competitive. This collaborative approach is likely to enhance the overall service offerings within the France Banking As A Service Market, as both parties benefit from shared expertise and resources. The growing interest in fintech is indicative of a broader shift towards a more dynamic financial ecosystem.

Growing Demand for Digital Banking Solutions

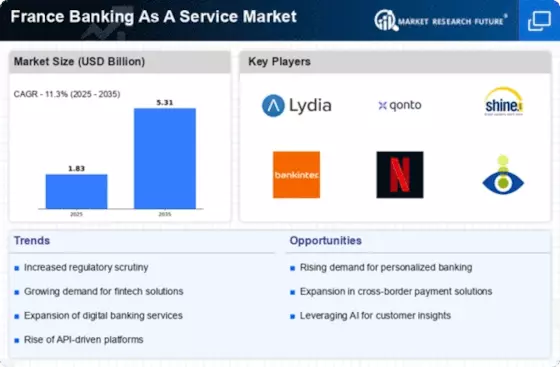

The France Banking As A Service Market is witnessing a notable surge in demand for digital banking solutions. As consumers increasingly prefer online and mobile banking, traditional banks are compelled to adapt their services. According to recent data, approximately 70% of French consumers utilize online banking services, indicating a shift towards digital platforms. This trend is further fueled by the rise of neobanks and fintech companies that offer innovative solutions. Consequently, established banks are collaborating with these entities to enhance their service offerings. The growing demand for seamless, user-friendly digital experiences is likely to drive the France Banking As A Service Market forward, as financial institutions strive to meet evolving customer expectations.

Technological Advancements in Financial Services

Technological advancements are playing a pivotal role in shaping the France Banking As A Service Market. Innovations such as artificial intelligence, blockchain, and cloud computing are transforming how financial services are delivered. For instance, AI-driven analytics are enabling banks to offer personalized services, while blockchain technology enhances security and transparency in transactions. The integration of these technologies is expected to streamline operations and reduce costs for financial institutions. As a result, the France Banking As A Service Market is likely to experience accelerated growth, as banks leverage these advancements to improve efficiency and customer satisfaction. The ongoing digital transformation is indicative of a broader trend towards modernization in the financial sector.