Growing Geriatric Population

The aging population in France is a significant driver of the atrial fibrillation-systems market. As individuals age, the risk of developing AF increases, leading to a higher demand for effective monitoring and treatment solutions. Current demographic trends indicate that by 2030, nearly 25% of the French population will be over 65 years old. This demographic shift is likely to result in a surge in AF cases, thereby necessitating the development and implementation of advanced atrial fibrillation systems. Healthcare providers are increasingly focusing on tailored solutions for the elderly, which may include remote monitoring and personalized treatment plans. This trend suggests a growing market potential for companies specializing in atrial fibrillation systems.

Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are significantly influencing the atrial fibrillation-systems market. In France, public health campaigns and funding programs are being implemented to raise awareness about AF and promote early detection and treatment. The French government has allocated substantial resources to enhance healthcare infrastructure, which includes the adoption of advanced atrial fibrillation systems. This financial support is likely to encourage healthcare providers to invest in new technologies and training, thereby expanding the market. Furthermore, the emphasis on preventive care and chronic disease management aligns with the objectives of the atrial fibrillation-systems market, suggesting a favorable environment for growth.

Rising Incidence of Atrial Fibrillation

The atrial fibrillation-systems market is experiencing growth due to the increasing incidence of atrial fibrillation (AF) in France. Recent studies indicate that approximately 1.5 million individuals in France are affected by AF, a condition that significantly raises the risk of stroke and other cardiovascular complications. This rising prevalence necessitates advanced monitoring and treatment solutions, thereby driving demand for atrial fibrillation systems. The healthcare system is adapting to this trend by investing in innovative technologies and treatment protocols. As the population ages, the number of AF cases is expected to rise, further propelling the atrial fibrillation-systems market. The need for effective management tools and devices is becoming increasingly critical, suggesting a robust market potential for stakeholders involved in the development and distribution of these systems.

Increased Focus on Preventive Healthcare

There is a notable shift towards preventive healthcare in France, which is positively impacting the atrial fibrillation-systems market. Healthcare professionals and policymakers are recognizing the importance of early detection and management of AF to prevent severe complications such as strokes. This focus on prevention is leading to increased investments in screening programs and educational initiatives aimed at both healthcare providers and patients. The integration of atrial fibrillation systems into routine healthcare practices is becoming more common, as these systems facilitate proactive management of the condition. As awareness grows, the demand for effective atrial fibrillation solutions is expected to rise, indicating a promising outlook for the market.

Technological Innovations in Cardiac Monitoring

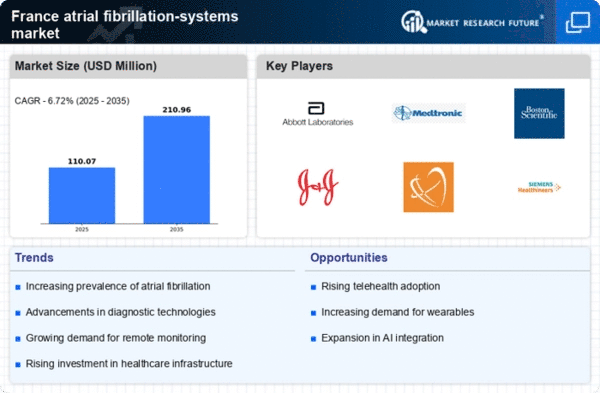

Technological advancements play a pivotal role in shaping the atrial fibrillation-systems market. Innovations such as wearable devices, mobile health applications, and advanced telemetry systems are enhancing the ability to monitor AF in real-time. These technologies not only improve patient outcomes but also facilitate timely interventions, which are crucial in managing AF effectively. The integration of artificial intelligence and machine learning into these systems is expected to further refine diagnostic accuracy and treatment personalization. In France, the market for these innovative solutions is projected to grow at a CAGR of around 10% over the next five years, indicating a strong shift towards technology-driven healthcare solutions in the atrial fibrillation-systems market.