Top Industry Leaders in the Fracking Chemicals Market

The fracking chemicals market, a potent cocktail of opportunity and controversy, is a battleground where giants clash and fortunes are made. Unraveling this complex space requires a deep dive into the strategies employed by key players, the factors influencing market share, the latest industry news, and the whispers of recent developments.

The fracking chemicals market, a potent cocktail of opportunity and controversy, is a battleground where giants clash and fortunes are made. Unraveling this complex space requires a deep dive into the strategies employed by key players, the factors influencing market share, the latest industry news, and the whispers of recent developments.

Strategies for Extracting Market Share:

-

Diversification Drill: Leading players like Halliburton, Schlumberger, and Baker Hughes are diversifying beyond traditional fracking chemicals like guar and friction reducers. They're venturing into biocides, scale inhibitors, and completion fluids tailored for specific formations and well depths, maximizing market reach. -

Technological Prowess: Innovation is the lifeblood of this industry. Companies like Dow Chemical and Ashland are investing heavily in research and development, focusing on greener fracking fluids with reduced environmental impact and improved efficiency. -

Regional Rigging: North America currently dominates the market, but Asia-Pacific is rapidly catching up. Companies are establishing local production facilities, forging partnerships with regional players, and customizing products to suit specific geological conditions, securing a foothold in high-growth markets. -

Vertical Integration Frac-ture: Some players are integrating upstream (chemical manufacturing) and downstream (well completion services) activities. This tightens supply chain control, optimizes costs, and offers a competitive edge. -

M&A Manoeuvers: Mergers and acquisitions play a crucial role in market consolidation. Schlumberger's acquisition of Cameron in 2014 broadened its fracking chemicals portfolio and strengthened its position in the industry.

Factors Shaping the Market Landscape:

-

Demand Drivers: Shale oil and gas production, driven by energy security concerns and advancements in drilling technologies, fuels demand for fracking chemicals. However, the transition towards renewable energy sources presents a long-term challenge. -

Regulatory Tightrope: Stringent environmental regulations, particularly in Europe and North America, are pushing for cleaner fracking fluids and stricter waste disposal practices. This presents both challenges and opportunities for innovation. -

Cost Pressures: Fluctuations in raw material prices (chemicals, water) and rising disposal costs can impact profitability for fracking companies. Optimizing fluid formulas and maximizing efficiency are crucial to stay afloat. -

Public Perception: Public concerns about the environmental impact of fracking, including water contamination and seismic activity, can lead to social and political pressures, impacting market sentiment and regulatory landscapes.

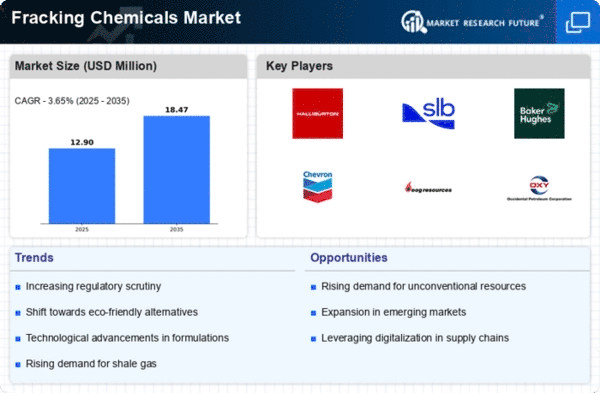

Key Players

Some of the major players operating in the global fracking chemicals market are AkzoNobel N.V. (The Netherlands), Ashland Inc. (US), Baker Hughes Incorporated (US), Halliburton. (US), Schlumberger Limited (US), BASF SE (Germany), Chevron Phillips Chemical Company (US), Clariant International AG (Switzerland), DowDuPont (US), Albemarle Corporation. (US), FTS International Inc. (US), Calfrac Well Services Ltd. (Canada), and EOG Resources, Inc. (US).

Recent Developments:

-

July 2023: Several lawsuits are filed against fracking companies in Argentina and Australia over alleged environmental damage, raising legal challenges for the industry in new markets. -

June 2023: Major advancements are made in the field of carbon capture and storage technologies, offering a potential solution for managing the greenhouse gas emissions associated with fracking. -

May 2023: The International Energy Agency releases a report suggesting a potential decline in global fracking activity in the long term due to the rise of renewables, casting uncertainty on the market's future growth.