Rising Focus on Sustainable Practices

The Frac Tank Market is increasingly influenced by a rising focus on sustainable practices within various sectors. Companies are recognizing the importance of minimizing their environmental footprint and are actively seeking solutions that align with sustainability goals. Frac tanks, which facilitate efficient water management and reduce waste, are becoming a preferred choice for companies aiming to adopt greener practices. Market data suggests that the sustainability sector is expected to grow at a rate of 7% annually, indicating a strong shift towards environmentally friendly solutions. This trend is likely to bolster the Frac Tank Market as businesses prioritize sustainability in their operational strategies.

Technological Innovations in Frac Tank Design

The Frac Tank Market is benefiting from ongoing technological innovations in frac tank design and functionality. Manufacturers are increasingly developing advanced frac tanks that offer enhanced durability, portability, and efficiency. Innovations such as integrated monitoring systems and modular designs are becoming more prevalent, allowing for better adaptability to various operational needs. This trend is supported by market data indicating that the demand for technologically advanced storage solutions is on the rise, with a projected increase of 5% in the next few years. As companies seek to optimize their operations, the Frac Tank Market is likely to see a surge in demand for these innovative solutions.

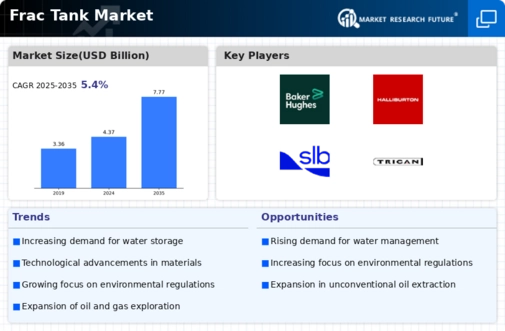

Expansion of Oil and Gas Exploration Activities

The Frac Tank Market is poised for growth due to the expansion of oil and gas exploration activities. As energy demands continue to rise, companies are increasingly investing in exploration and production, particularly in shale formations. This surge in exploration activities necessitates the use of frac tanks for efficient water storage and management during hydraulic fracturing processes. Market data reveals that the oil and gas exploration sector is projected to grow by approximately 4% annually over the next decade. This growth is likely to create a favorable environment for the Frac Tank Market, as the need for reliable storage solutions becomes more pronounced in the face of increased drilling activities.

Increased Demand for Water Management Solutions

The Frac Tank Market is experiencing heightened demand for effective water management solutions. As water scarcity becomes a pressing issue, industries are seeking efficient methods to store and manage water resources. Frac tanks, known for their large storage capacities, are increasingly utilized in hydraulic fracturing operations to ensure a steady supply of water. This trend is further supported by data indicating that the water management sector is projected to grow at a compound annual growth rate of 6.5% over the next five years. Consequently, the Frac Tank Market is likely to benefit from this growing emphasis on sustainable water usage, as companies invest in infrastructure that supports efficient water management practices.

Regulatory Compliance and Environmental Standards

The Frac Tank Market is significantly influenced by stringent regulatory compliance and environmental standards. Governments are implementing more rigorous regulations concerning waste management and environmental protection, compelling companies to adopt safer and more efficient storage solutions. Frac tanks, designed to meet these standards, provide a reliable option for storing hazardous materials and wastewater. The market data suggests that the compliance costs for companies in the oil and gas sector are expected to rise, which may drive the adoption of frac tanks as a cost-effective solution for meeting regulatory requirements. This trend indicates a potential growth trajectory for the Frac Tank Market as companies prioritize compliance and environmental responsibility.