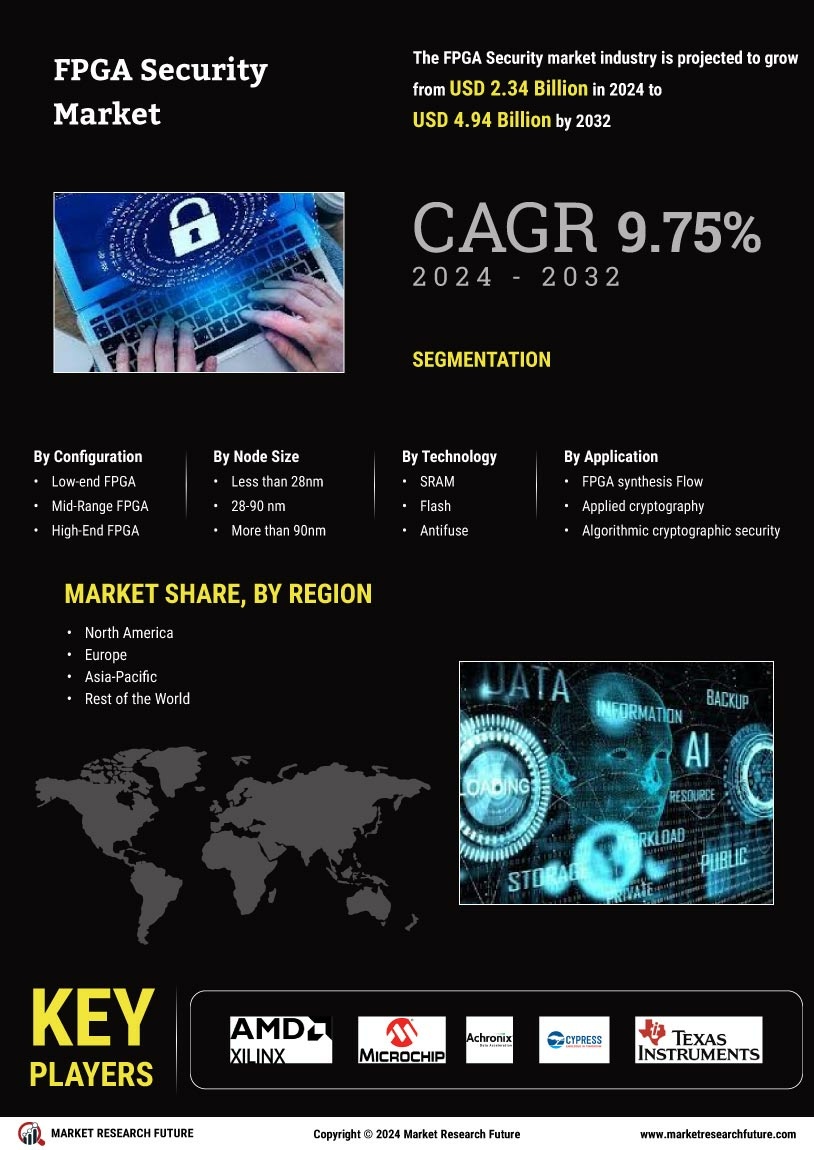

Leading market players are investing heavily in research and development to expand their product lines, which will help the FPGA security market grow even more. There are some strategies for action that market participants are implementing to increase their presence around the world's global footprint, with important market developments including new product launches, contractual agreements and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the FPGA security industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer use in the global FPGA security industry to benefit clients and increase the market sector. In recent years, the FPGA security industry has offered some of the most significant technological advancements. Major players in the FPGA security market, including Xilinx Inc., Microchip Technology Inc., Achronix Semiconductor Corporation, Cypress Semiconductor Corporation, Texas Instruments Incorporated, Lattice Semiconductor, Intel Corporation, Financial Overview, Quicklogics Corp., and Teledyne Technologies Inc., and others are attempting to grow market demand by investing in research and development operations.

AMD has significantly accelerated innovation in graphics, visualization, and high-performance computing. Billions of people worldwide utilize AMD technology daily to improve their lives, careers, and leisure activities. Top Fortune 500 businesses and leading-edge institutions for scientific research are included in this. AMD staff members focus primarily on developing flexible, high-performance solutions that stretch the bounds of what is possible. When AMD was established as a Silicon Valley start-up in 1969, hundreds of employees were enthusiastic about creating cutting-edge semiconductor devices at the company's inception.

AMD has become a worldwide company defining the standard for modern computing thanks to several key industry firsts and substantial technological advancements.

In June AMD announced the addition of two new, workload-optimized processors to its array of 4th Gen EPYCTM CPUs. By leveraging the new "Zen 4c" core architecture, the AMD EPYC 97X4 cloud native-optimized data center CPUs advance the EPYC 9004 Series of processors by offering the thread density and scale necessary for leading-edge cloud native computing.

Microchip Technology, Inc. is an industry-recognized pioneer in embedded control systems that are intelligent, networked, and secure. With its user-friendly development tools and a broad choice of products, customers can create the finest designs possible, lowering risk while reducing total system cost and time to market. In the industrial, automotive, consumer, aerospace and defense, communications, and computer industries, the company's products are used by more than 125,000 clients. Microchip's headquarters in Chandler, Arizona, offers superb technical support, dependable shipping, and premium goods.

In January 2023, Microchip Technology Inc. announced its first radiation-tolerant commercial off-the-shelf (COTS) power device, the MIC69303RT 3A Low-Dropout (LDO) Voltage Regulator. The MIC69303RT, a revolutionary high current and low voltage power management solution targeted at LEO and other space applications, is an example.