Formaldehyde Size

Formaldehyde Market Growth Projections and Opportunities

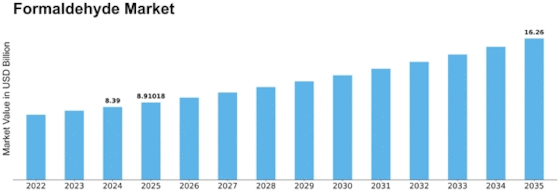

There are a number of influences on the formaldehyde market; all these factors act together to shape its dynamics and growth. The global demand for products made using formaldehyde, which includes resins, adhesives, and textiles, is one of the most important determinants. With industrialization spreading to various parts of the world, many sectors such as construction, automotive, and healthcare require these items, thus increasing the value of the formaldehyde market. At the same time, regulatory standards in environmental protection play a significant role in determining dynamics within this market. It was priced at $7.5 billion in 2022. In addition to that, from $7.9 billion in 2023 to $12.88 billion by 2032, the Formaldehyde industry is estimated to Register a CAGR of 6.20%. Moreover, raw material availability and cost are crucial drivers for the size of this market. For making formaldehyde, methanol, which acts as the main intermediate product, is usually derived from natural gas, coal, and biomass resources. This means that when there are changes in the pricing system relating to these inputs, it automatically reflects on production costs, thus affecting final prices for formaldehyde, including its derivatives. Geopolitical factors also influence Formelhyde'smarket. Put another way, trade relations between countries and tariff disputes between nations affect the uptake of foreign products with reference to formaldehyde, hence causing either gain or loss on shares held by different regions. As such, the political situation tends to change now and then, bearing an effect on business planning. In this regard, technological advancement has shaped the formaldehyde business. Making new forms of manufacturing processes that can be environmentally friendly helps save on materials used, making them more efficient than before. Also, it improves production quality, leading to changing trends in formelhides business. In addition, environmental concerns, among other things, affect tastes and preferences among consumers with respect to the use of formaldehyde. The shift towards "going green" and environmentally friendly products has seen consumers demanding formaldehyde-free alternatives owing to the manufacturing technologies that are kinder to the environment. The economic landscape, such as GDP growth rates, inflation rates, and general economic conditions, drive the formaldehyde industry. A decline in economic activities may lead to decreased construction and manufacturing works, thus affecting the demand for goods made from formelhides. However, during times of increased infrastructure development and economic prosperity, the construction sector experiences a high demand for formelhydes.

Leave a Comment