Top Industry Leaders in the Formaldehyde Market

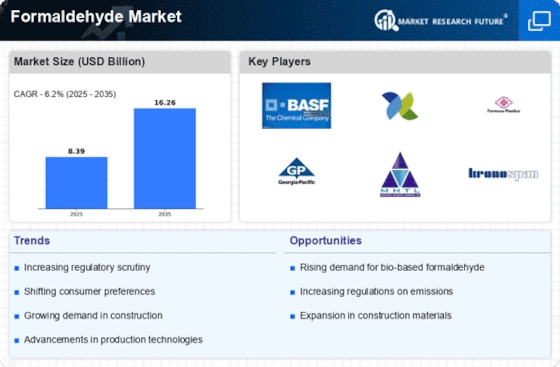

Formaldehyde, a versatile yet controversial chemical, finds its way into countless everyday products, from furniture and plywood to adhesives and disinfectants. Its global market is driven by its diverse applications and a steady rise in demand across various industries. However, the competitive landscape of this market is complex and dynamic, shaped by a unique interplay of factors and evolving trends.

Strategies Driving Market Share:

-

Product Diversification: Leading players are expanding their portfolios beyond traditional formaldehyde products, venturing into formaldehyde-free alternatives and eco-friendly resins. BASF, for example, recently introduced its Formica Terrazzo formaldehyde-free resin for countertops. -

Technological Innovation: Investments in new production technologies and catalysts are optimizing efficiency and reducing environmental impact. For instance, Georgia-Pacific Chemicals introduced its FORMOPURE™ technology, minimizing emissions and energy consumption. -

Regional Expansion: Emerging economies like China and India are witnessing a construction boom, fuelling demand for formaldehyde in building materials. Companies are strategically establishing production facilities in these regions to capitalize on this growth. -

Sustainability Focus: Stringent regulations on formaldehyde emissions and growing consumer awareness are pushing companies to adopt greener practices. Methanol-to-olefins (MTO) technology, which offers a more sustainable route to formaldehyde production, is gaining traction. -

Mergers and Acquisitions: Consolidation is a key trend, with major players acquiring smaller companies to gain market share, access new technologies, and diversify their offerings. The 2021 acquisition of Dynea AS by Hexion Inc. is a prime example of this strategy.

Factors Influencing Market Share:

-

Cost Competitiveness: The low production cost of formaldehyde makes it an attractive choice for manufacturers, but price wars can squeeze profit margins and hinder innovation. -

Raw Material Availability: Fluctuations in methanol prices, the primary raw material for formaldehyde, can impact production costs and market stability. -

Regulatory Environment: Stricter regulations on formaldehyde emissions, particularly in Europe and North America, are driving the development of safer alternatives and impacting market dynamics. -

Consumer Preferences: Growing awareness of formaldehyde's health hazards is pushing consumers towards formaldehyde-free products, prompting companies to adapt their offerings.

List of Key Players in the Formaldehyde Market

-

Foremark Performance Chemicals

-

Hexion

-

Georgia-Pacific Chemicals

-

Celanese Corporation

-

BASF SE

-

Capital Resin Corporation

-

Evonik Industries AG

-

DuPont

-

Alfa Aesar

-

Ashland

-

Perstorp

-

LRBG Chemicals Inc

Recent Developments:

July 2023: Perstorp AB announced the launch of its EcoProForm™, a formaldehyde-free resin for plywood, targeting the furniture and construction industries.

August 2023: Celanese Corporation partnered with Lanzhou Huate Chemical Co. Ltd. to build a new formaldehyde production plant in China, aiming to meet growing demand in the region.

September 2023: Huntsman Corporation announced a $100 million investment in its Texas facility to upgrade its formaldehyde production technology and improve energy efficiency.

October 2023: Momentive Specialty Chemicals Inc. and LanzaTech collaborated to develop a bio-based formaldehyde production process using renewable methanol, a potential game-changer for sustainability.

November 2023: The United States Environmental Protection Agency (EPA) proposed new formaldehyde emission standards for plywood and laminated flooring, further tightening regulations in the North American market.

December 2023: A coalition of environmental groups filed a lawsuit against the EPA for failing to adequately regulate formaldehyde emissions from composite wood products.