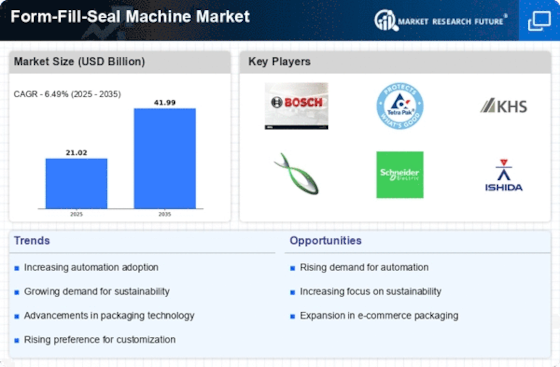

Top Industry Leaders in the Form Fill Seal Machine Market

The form-fill-seal (FFS) machine market, the silent hero behind countless packaged goods, is poised for significant growth.These versatile machines automate the process of forming packaging material, filling it with product, and sealing it shut, ensuring efficiency, hygiene, and consistent quality. But beneath the seemingly mundane surface lies a fierce competition, where established giants and ambitious newcomers battle for market share.

Strategic Maneuvers Shaping the Market:

-

Industry Titans: Companies like Bosch Rexroth, Syntegon Technology, and Sidel leverage their extensive global reach, established production capacities, and diverse FFS machine portfolios to maintain dominance. Their strategies focus on technological advancements, strategic acquisitions, and building strong partnerships with packaging material suppliers.

-

Regional Champions: Regional players like Jiangsu Yizumi Machinery and Yamakawa Manufacturing hold strong positions in their respective markets. They compete on price, cater to regional preferences, and offer customized FFS solutions for local needs.

-

Niche Innovators: Emerging players like GEA Group and Sealed Air Corporation carve niches with specialized FFS machines for unique applications like high-barrier packaging, liquid filling, or sustainable solutions. They capitalize on their expertise and cater to specific customer segments, often at premium prices.

Factors Dictating Market Share:

-

Machine Capability and Versatility: Offering FFS machines capable of handling diverse packaging materials, product types, and production speeds caters to a wider customer base and increases market share. Continuous innovation in machine design and functionality is crucial. -

Cost-Effectiveness and Efficiency: Optimizing production processes, offering reliable machines with minimal downtime, and competitive pricing are crucial for gaining market share, particularly in price-sensitive segments. -

Sustainability and Environmental Impact: Developing energy-efficient FFS machines with recyclable or biodegradable components addresses environmental concerns and opens doors to markets with strict sustainability regulations. -

Technical Support and Customer Service: Providing excellent technical support, application expertise, and spare parts availability builds trust and repeat business, leading to market share consolidation. -

Regional Growth and Emerging Applications: Identifying high-growth regions like Asia-Pacific and catering to emerging applications like e-commerce and personalized packaging presents significant market share opportunities.

Key Players:

- Robert Bosch GmbH (Germany),

- JBT Corporation (US),

- Haver & Boecker OHG (Germany),

- Arpac LLC (U.S),

- KHS GmbH (Germany),

- Krones AG (Germany),

- Scholle IPN Corporation (U.S),

- Pro Mach Inc. (US),

- GEA Group AG (Germany)

Recent Developments:

-

September 2023: Bosch Rexroth introduces a compact and modular FFS machine specifically designed for small and medium-sized businesses, caterin to the growing demand for flexible packaging solutions. -

October 2023: Sealed Air Corporation acquires a leading manufacturer of bio-based flexible packaging materials, strengthening its focus on sustainable FFS solutions. -

November 2023: A group of researchers at MIT unveils a prototype FFS machine capable of 3D printing customized packaging on-demand, paving the way for personalized and waste-free packaging. -

December 2023: Jiangsu Yizumi Machinery announces plans for a new production facility in Southeast Asia, targeting the high-growth packaging market in the region.