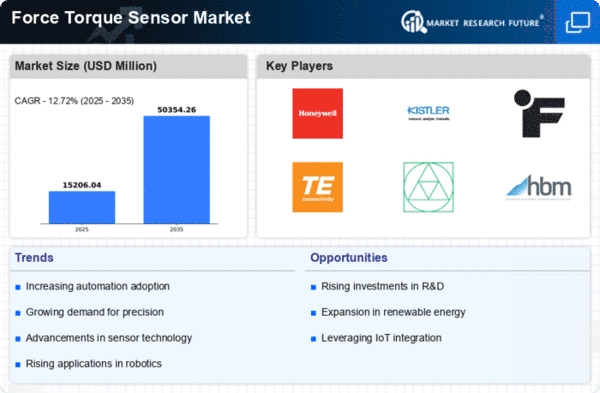

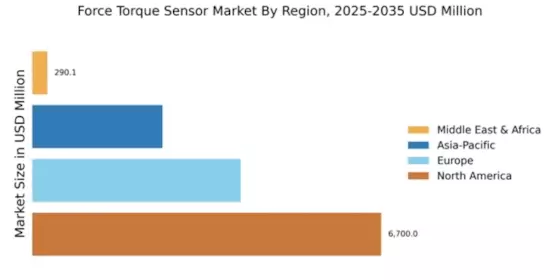

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Force Torque Sensor market, holding a significant share of 6700.0. The region's growth is driven by advancements in technology, increasing automation in manufacturing, and stringent safety regulations. The demand for precision measurement tools is rising, particularly in aerospace and automotive sectors, where accuracy is paramount. Regulatory support for innovation further fuels market expansion. The competitive landscape in North America is robust, featuring key players such as Honeywell, FUTEK, and TE Connectivity. These companies are investing heavily in R&D to enhance product offerings and meet evolving customer needs. The U.S. stands out as a major contributor, supported by a strong industrial base and a focus on smart manufacturing solutions. This environment fosters collaboration between industry and academia, driving further advancements in sensor technology.

Europe : Emerging Market with Growth Potential

Europe's Force Torque Sensor market is projected to grow significantly, with a market size of 4000.0. The region benefits from a strong emphasis on industrial automation and the adoption of Industry 4.0 technologies. Regulatory frameworks promoting energy efficiency and sustainability are key drivers, encouraging manufacturers to integrate advanced sensor technologies into their operations. The demand for high-precision sensors is particularly strong in the automotive and manufacturing sectors. Leading countries in Europe include Germany, France, and the UK, where companies like Siemens and HBM are making substantial contributions. The competitive landscape is characterized by a mix of established players and innovative startups, fostering a dynamic environment for growth. The European market is also witnessing increased collaboration between industry and research institutions, enhancing the development of cutting-edge sensor solutions.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region is experiencing rapid growth in the Force Torque Sensor market, with a size of 2500.0. This growth is driven by increasing industrialization, particularly in countries like China and India, where manufacturing sectors are expanding. The demand for automation and precision measurement tools is rising, supported by government initiatives aimed at enhancing manufacturing capabilities. Regulatory frameworks are evolving to promote safety and efficiency in industrial operations. China leads the region in market share, with significant contributions from local manufacturers and global players like Vishay Precision Group. The competitive landscape is becoming increasingly dynamic, with a focus on innovation and cost-effective solutions. As industries in the region continue to modernize, the demand for advanced sensor technologies is expected to grow, positioning Asia-Pacific as a key player in the global market.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa (MEA) region presents unique opportunities in the Force Torque Sensor market, with a size of 290.1. The growth is driven by increasing investments in infrastructure and industrial projects, particularly in the Gulf Cooperation Council (GCC) countries. Regulatory initiatives aimed at enhancing safety and efficiency in industrial operations are also contributing to market expansion. The demand for advanced sensor technologies is rising as industries seek to improve operational efficiency. Leading countries in the region include the UAE and South Africa, where there is a growing presence of both local and international players. The competitive landscape is characterized by a mix of established companies and emerging startups, focusing on innovative solutions tailored to regional needs. As the MEA region continues to develop its industrial base, the demand for force torque sensors is expected to increase, driven by ongoing infrastructure projects and technological advancements.