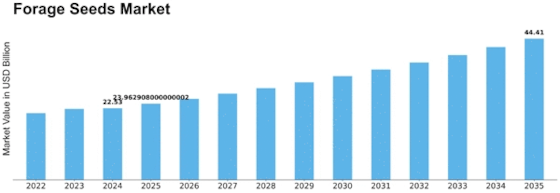

Forage Seeds Size

Forage Seeds Market Growth Projections and Opportunities

The Forage Seeds Market is trended by a dynamic interaction of various factors that together have an impact on its increase and evolution. In the middle of those market dynamics lies the worldwide demand for farm animal feed, driven by the increasing populace and the subsequent upward push in demand for meat and dairy merchandise. Forage seeds, which consist of grasses and legumes cultivated for animal fodder, play a pivotal role in meeting this developing demand. One of the important thing dynamics propelling the forage seeds market is the ever-increasing farm animal industry. As the worldwide population continues to increase, so does the demand for meat and dairy merchandise. This surge in demand for without delay impacts the demand for top-notch forage, using the cultivation and usage of forage seeds. Livestock farmers are more and more recognizing the importance of nutritious and efficient forage in improving the health and productiveness of their animals, further fueling the market dynamics. Climate conditions and environmental elements also appreciably influence the forage seeds market dynamics. Forage plants are enormously dependent on climate styles, and variations in temperature and precipitation can affect both the quality and quantity of forage manufacturing. As weather alternate turns into an increasingly pressing situation, it introduces a detail of uncertainty into the forage seeds market. Breeders and farmers ought to adapt to changing climatic conditions, leading to a continuous evolution within the styles of forage seeds cultivated. Innovation and improvements in agricultural technology contribute significantly to the dynamics of the forage seeds market. Continuous studies and development efforts result in the creation of progressed forage seed types that provide superior nutritional content, resilience to pests and illnesses, and flexibility to numerous environmental conditions. Global alternate dynamics additionally play a role in shaping the forage seeds market. As the world becomes more interconnected, the import and export of forage seeds end up necessary additives to the market dynamics. Access to new markets, international collaborations, and exchange agreements affect the availability and distribution of forage seeds, growing a complex and interconnected global market landscape. In the end, the forage seeds market is a dynamic and multifaceted zone prompted by elements that include population boom, climate conditions, technological advancements, government rules, purchaser choices, and international alternate dynamics. As the demand for outstanding farm animal products keeps on an upward push, the forage seeds market will undergo continuous evolution, pushed by the need for sustainable and efficient forage manufacturing.

Leave a Comment