Regulatory Support

The Fluorescent Lighting Market benefits from a robust framework of regulations aimed at promoting energy-efficient lighting solutions. Governments across various regions have implemented standards and incentives to encourage the use of fluorescent lighting, which is often more energy-efficient compared to traditional incandescent bulbs. For instance, regulations mandating energy efficiency ratings for lighting products have spurred manufacturers to innovate and improve their offerings. Additionally, financial incentives, such as rebates for energy-efficient lighting installations, further stimulate market growth. As a result, the market is expected to see a steady increase in demand for fluorescent lighting products, driven by both regulatory compliance and consumer awareness of energy conservation.

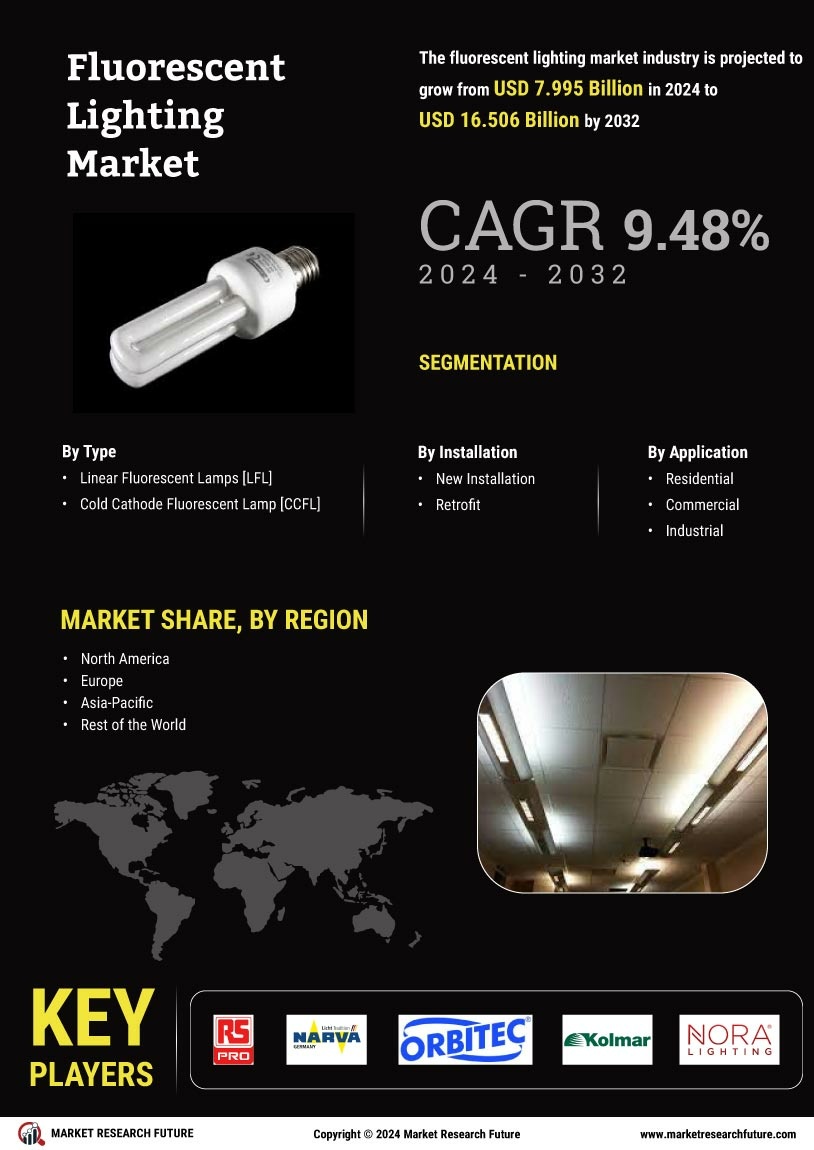

Diverse Application Areas

The Fluorescent Lighting Market is characterized by its diverse application areas, which contribute to its sustained growth. Fluorescent lighting is utilized in various settings, including commercial, industrial, and residential environments. Its versatility makes it suitable for a wide range of applications, from office spaces to retail stores and manufacturing facilities. The demand for fluorescent lighting in these sectors is driven by its ability to provide bright, efficient illumination while maintaining cost-effectiveness. Recent market analyses suggest that the commercial sector alone accounts for a substantial share of the fluorescent lighting market, indicating a strong potential for growth. As businesses continue to seek effective lighting solutions, the Fluorescent Lighting Market is likely to expand further.

Technological Advancements

The Fluorescent Lighting Market is experiencing a wave of technological advancements that enhance the efficiency and performance of fluorescent lighting solutions. Innovations in ballast technology, such as electronic ballasts, have improved energy efficiency and reduced flickering, thereby increasing the lifespan of fluorescent lamps. Furthermore, the integration of smart technologies, including sensors and controls, allows for better management of lighting systems, contributing to energy savings. According to recent data, the adoption of advanced fluorescent lighting technologies is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This trend indicates a shift towards more sophisticated lighting solutions that not only meet energy standards but also cater to consumer preferences for convenience and control.

Growing Construction Sector

The Fluorescent Lighting Market is poised for growth due to the expansion of the construction sector. As urbanization continues to rise, there is an increasing demand for commercial and residential buildings, which in turn drives the need for effective lighting solutions. Fluorescent lighting is often favored in new constructions due to its energy efficiency and cost-effectiveness. Recent statistics indicate that the construction industry is projected to grow by approximately 4% annually, leading to a corresponding increase in the demand for lighting solutions. This trend suggests that the Fluorescent Lighting Market will benefit significantly from the ongoing construction activities, as builders and developers seek to incorporate energy-efficient lighting into their projects.

Increased Awareness of Energy Conservation

The Fluorescent Lighting Market is witnessing a surge in demand driven by heightened awareness of energy conservation among consumers and businesses alike. As energy costs continue to rise, there is a growing emphasis on adopting energy-efficient lighting solutions that can reduce electricity bills and environmental impact. Fluorescent lighting, known for its lower energy consumption compared to traditional lighting options, is becoming a preferred choice for many. Surveys indicate that a significant percentage of consumers are now prioritizing energy efficiency when making purchasing decisions. This shift in consumer behavior is likely to propel the Fluorescent Lighting Market forward, as more individuals and organizations seek to implement sustainable lighting practices.