Top Industry Leaders in the Fluid Power Equipment Market

*Disclaimer: List of key companies in no particular order

The Fluid Power Equipment Market Intense Competitive Scenario

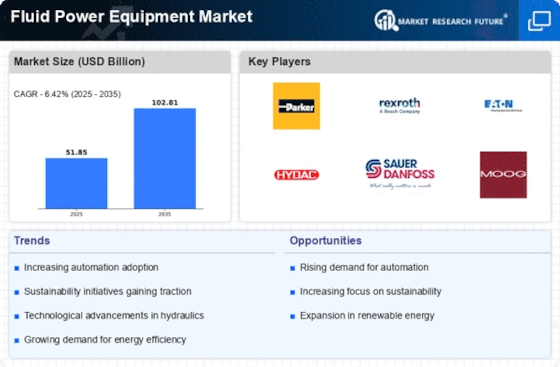

Anticipated to undergo substantial expansion in the forthcoming years, the global fluid power equipment market is poised for growth. This surge is attributed to factors such as the escalating wave of automation, heightened demand from pivotal end-use sectors like automotive and construction, and an escalating awareness concerning energy efficiency. This surge has magnetized a diverse array of participants, resulting in a fluid and fiercely competitive landscape.

Strategies of Key Players:

- Bosch Rexroth

- Eaton Corporation

- Parker Hannifin

- Kawasaki

- Fluid-Power Equipment Inc

- Sparrows Group

- Fluid Systems Inc

- AGILOX

- Kent Fluid Power Ltd

- Moog Inc

- Daikin among others

Major entities in the fluid power equipment domain are adopting a spectrum of tactics to maintain a competitive edge. These encompass:

-

Product Innovation: A substantial investment in research and development is underway to engineer novel and enhanced products boasting superior performance, efficiency, and reliability. This includes advancements in hydraulics, pneumatics, and electronic controls. -

Expansion and Diversification: Firms are broadening their geographical footprint by venturing into novel markets and establishing local manufacturing facilities. Simultaneously, they're diversifying their product repertoire to cater to a broader spectrum of end-use applications. -

Mergers and Acquisitions: The consolidation trend persists, with companies resorting to mergers and acquisitions to augment their market share and access new technologies and resources. -

Strategic Partnerships: Collaborations with other industry players, such as distributors, suppliers, and technology providers, are becoming commonplace. This facilitates the leverage of mutual strengths and the broadening of their collective reach. -

Sustainability Focus: There is a discernible shift towards the development of environmentally friendly products and solutions. This encompasses the reduction of energy consumption, utilization of sustainable materials, and minimization of waste.

Factors Governing Market Share Analysis:Diverse factors come into play when assessing the market share of different entities in the fluid power equipment sector. These include:

-

Market Revenue: The aggregate revenue derived from the sale of fluid power equipment. -

Market Share: The percentage of the total market held by a particular entity. -

Product Portfolio: The scope of products offered, spanning hydraulic pumps, valves, cylinders, and actuators. -

Geographical Reach: The extent of a company's operations across various countries. -

Customer Base: The magnitude and diversity of a company's customer base. -

Brand Reputation: The standing of a company in terms of quality, reliability, and innovation. -

Financial Performance: The fiscal health, encompassing revenue, profitability, and debt levels.

Emerging Trends:Several nascent and evolving trends are sculpting the competitive panorama of the fluid power equipment sector. These include:

-

Digitalization: The escalating integration of digital technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), to enhance the efficiency and performance of fluid power systems. -

Electrification: The surging inclination towards electrifying machinery and equipment is propelling the demand for electric pumps and actuators. -

Industry 4.0: The infusion of digital technologies into the manufacturing process is opening new avenues for fluid power equipment. -

Aftermarket Services Focus: Companies are increasingly prioritizing the provision of aftermarket services, including maintenance, repair, and training, to establish recurrent revenue streams. -

Sustainability: The growing demand for eco-friendly products is steering the development of innovative technologies, such as energy-efficient pumps and biodegradable lubricants.

Overall Competitive Landscape:The competitive landscape of the fluid power equipment market is anticipated to retain its intensity in the years to come. This is attributable to various factors, including:

-

High Growth Potential: The market's anticipated robust growth is luring new entrants, intensifying the competitive milieu. -

Technological Advancements: The brisk pace of technological progress continually reshapes the landscape, necessitating constant innovation and adaptability. -

Global Competition: The market is progressively assuming a global character, with players from diverse corners of the world vying for market share. -

Customer-Centric Approach: Companies are increasingly directing their efforts towards comprehending and meeting the specific needs of their customer base.

Success in this domain demands innovation, adaptability, and a customer-centric ethos. Additionally, building a robust brand reputation and substantial investments in research and development are imperative to stay ahead in this fiercely competitive arena.

Industry Developments and Latest Updates:

Bosch Rexroth: On October 26, 2023, Bosch Rexroth unveiled its latest CytroForce hydraulic cylinders, promising enhanced efficiency and performance for mobile hydraulic applications. (Source: Bosch Rexroth press release)

Eaton Corporation: On November 15, 2023, Eaton Corporation disclosed the acquisition of Hydraulik Buch, a German manufacturer specializing in hydraulic valves and pumps. This strategic move aims to fortify Eaton's position in the fluid power market. (Source: Eaton Corporation press release)

Parker Hannifin: December 5, 2023, witnessed Parker Hannifin entering a partnership with Siemens to coalesce efforts in developing and supplying fluid power systems for Siemens' upcoming wind turbine platforms. (Source: Parker Hannifin press release)

Kawasaki: November 1, 2023, saw Kawasaki announcing the fruition of a groundbreaking high-pressure hydraulic pump designed to operate at pressures up to 70 MPa. This innovation is tailored for demanding applications like oil and gas exploration. (Source: Kawasaki press release)