Growing Industrialization

The Flue Gas Treatment System Market is significantly influenced by the ongoing trend of industrialization across various sectors. As manufacturing and energy production ramp up, the volume of flue gases generated increases, necessitating effective treatment solutions. Industries such as power generation, cement, and steel are particularly notable contributors to flue gas emissions. The market is projected to witness substantial growth, with estimates indicating an increase in demand for flue gas treatment systems by approximately 6% annually. This growth is driven by the need for industries to mitigate their environmental impact and comply with stringent regulations, thereby fostering a favorable environment for the flue gas treatment system market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Flue Gas Treatment System Market. Innovations such as selective catalytic reduction (SCR) and flue gas desulfurization (FGD) systems are becoming increasingly prevalent. These technologies not only improve the efficiency of pollutant removal but also reduce operational costs for industries. The integration of artificial intelligence and machine learning in monitoring and controlling emissions is also gaining traction. As industries seek to optimize their processes and reduce their carbon footprint, the demand for these advanced flue gas treatment technologies is expected to rise. This trend indicates a potential market expansion, as companies invest in state-of-the-art solutions to meet evolving environmental standards.

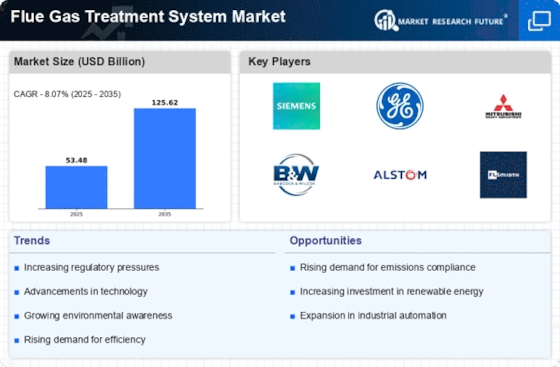

Increasing Regulatory Pressure

The Flue Gas Treatment System Market is experiencing heightened regulatory pressure as governments worldwide implement stricter environmental regulations. These regulations aim to reduce emissions of harmful pollutants such as sulfur dioxide, nitrogen oxides, and particulate matter. As a result, industries are compelled to invest in advanced flue gas treatment technologies to comply with these standards. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This growth is driven by the need for industries to avoid penalties and enhance their sustainability profiles, thereby creating a robust demand for flue gas treatment systems.

Investment in Renewable Energy

Investment in renewable energy sources is emerging as a significant driver for the Flue Gas Treatment System Market. As countries transition towards cleaner energy alternatives, the demand for flue gas treatment systems in traditional energy sectors remains robust. Renewable energy projects often require complementary technologies to manage emissions from existing fossil fuel operations. The market is expected to grow as investments in renewable energy infrastructure increase, with projections indicating a potential rise in flue gas treatment system adoption by around 4% annually. This trend reflects a broader commitment to reducing carbon emissions while maintaining energy production efficiency.

Rising Awareness of Environmental Issues

The Flue Gas Treatment System Market is benefiting from a growing awareness of environmental issues among consumers and businesses alike. As public concern regarding air quality and climate change intensifies, industries are increasingly motivated to adopt cleaner technologies. This shift is prompting companies to invest in flue gas treatment systems to enhance their environmental credentials and meet consumer expectations. Market data suggests that companies prioritizing sustainability are likely to experience a competitive advantage, leading to a projected increase in the adoption of flue gas treatment technologies. This trend indicates a potential for market growth as industries align their operations with environmentally responsible practices.