- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

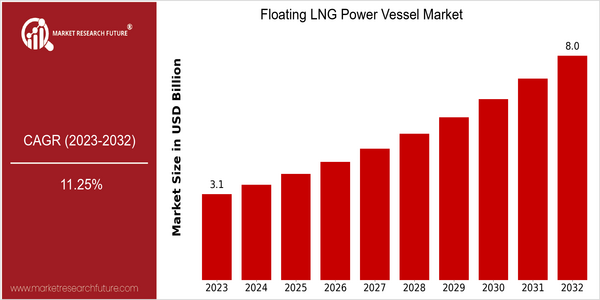

| Year | Value |

|---|---|

| 2023 | USD 3.06 Billion |

| 2032 | USD 8.0 Billion |

| CAGR (2024-2032) | 11.25 % |

Note – Market size depicts the revenue generated over the financial year

The Floating Lng Power Vessels Market is estimated to reach USD 3.06 billion by 2023 and to reach USD 8.0 billion by 2032. This represents a strong CAGR of 11.25% from 2024 to 2032. The growing demand for cleaner energy sources and the need for flexible and efficient power generation solutions are driving this upward trend. Also, the advancement of floating Lng technology, such as enhanced storage capacity and improved regasification, is expected to increase market growth. The key players in the Floating Lng Power Vessels sector, such as Excelerate Energy, Golar Lng and Hoegh Lng, are currently launching strategic initiatives to take advantage of this growth. These initiatives include developing new projects, investing in innovative vessel designs and launching new, advanced floating power generation units. As the world moves toward cleaner energy, the Floating Lng Power Vessels Market is well positioned to play a critical role in meeting future energy demands and reducing carbon emissions.

Regional Market Size

Regional Deep Dive

In recent years the Floating LNG Power Vessel market has grown rapidly in various regions. This growth is due to the rising demand for cleaner energy and the need for flexible power generation solutions. North America is characterized by a strong focus on energy independence and regulatory compliance, while Europe is characterized by a focus on energy efficiency and innovation in energy technology. The Asia-Pacific region is experiencing rapid industrialization and urbanization, which in turn increases energy consumption. In the Middle East and Africa, the focus is on utilizing local gas resources to ensure energy security. Latin America is gradually introducing floating LNG technology to diversify its energy mix and improve energy access. Each region offers its own opportunities and challenges, which in turn influence the market dynamics.

Europe

- The European Union's Green Deal aims to transition to a carbon-neutral economy by 2050, which is driving investments in floating LNG technologies as a cleaner alternative to traditional fossil fuels.

- Notable projects, such as the Golar LNG's floating power plant in the UK, are setting benchmarks for efficiency and sustainability in the floating LNG sector, influencing regulatory frameworks across Europe.

Asia Pacific

- Countries like Japan and South Korea are leading the charge in adopting floating LNG power vessels to enhance energy security and reduce reliance on coal, spurred by government policies promoting cleaner energy.

- The region is witnessing significant investments from companies like Mitsui O.S.K. Lines and Shell, which are developing floating LNG projects to cater to the increasing energy demands of rapidly growing economies.

Latin America

- Brazil is exploring floating LNG power vessels to improve energy access in remote areas, supported by government initiatives aimed at enhancing energy infrastructure.

- Companies like Petrobras are investing in floating LNG projects to diversify their energy portfolio and reduce carbon emissions, reflecting a growing trend towards cleaner energy sources in the region.

North America

- The U.S. Department of Energy has been actively promoting the use of floating LNG power vessels as part of its strategy to enhance energy security and reduce greenhouse gas emissions, leading to increased investments in this sector.

- Companies like Excelerate Energy and Höegh LNG are pioneering projects in the U.S. Gulf Coast, focusing on the deployment of floating LNG solutions to meet the growing energy demands of the region.

Middle East And Africa

- The UAE is investing heavily in floating LNG technology as part of its diversification strategy away from oil dependency, with projects like the Dubai Floating LNG Terminal set to enhance energy supply stability.

- Saudi Arabia's Vision 2030 initiative includes plans to utilize floating LNG power vessels to support its renewable energy goals, showcasing a shift towards more sustainable energy solutions in the region.

Did You Know?

“Floating LNG power vessels can be deployed in less than half the time it takes to build traditional land-based power plants, making them a flexible solution for rapidly changing energy demands.” — International Maritime Organization (IMO)

Segmental Market Size

The Floating Liquefied Natural Gas Power Vessels segment is playing a key role in the energy market, especially in regions with little access to the usual energy network. This segment is currently growing, driven by rising energy demand and the need for cleaner energy solutions. The main drivers are the decarbonization of the economy, the regulatory framework which favors the use of natural gas as a transitional fuel, and technological developments which increase the efficiency and safety of floating natural gas solutions. Floating Liquefied Natural Gas Power Vessels are currently at the stage of introducing them on a large scale, with notable projects such as Exmar’s Caribbean FLNG and Golar LNG’s Hilli Episeyo leading the way. These vessels are mainly used to generate electricity in remote areas, offshore gas fields and regions with energy deficits. The trends towards decarbonization and the use of natural gas as a transitional fuel are accelerating the growth of this segment. Furthermore, the technological innovations in the field of Floating Liquefied Natural Gas Power Vessels, including the improved method of liquefying and re-gasifying, will determine the evolution of this industry and expand its application in the global energy landscape.

Future Outlook

From 2023 to 2032, the floating LNG power supply vessel market is expected to grow at a CAGR of 11.25%. This is driven by the increasing demand for clean energy and the need for flexible power generation in remote areas with poor access to energy resources. Since the floating LNG power supply system has a lower carbon dioxide emissions compared to coal-fired and oil-fired power plants, it is becoming an attractive option for countries with low-carbon energy plans. Also, key technological developments, such as the development of LNG storage and regasification, will improve the efficiency and reliability of floating LNG power supply vessels. Government support for the development of offshore renewable energy will also stimulate the market. Moreover, the integration of floating LNG power supply systems with offshore wind power and the development of digital technology for operation optimization will play an important role in determining the market trend. By 2032, the floating LNG power supply system will be an important part of the world's energy supply, especially in emerging economies where energy demand is increasing.

Floating LNG Power Vessel Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.