Market Growth Chart

The Global FLIR and Laser Designator Targeting Pods Market Industry is projected to exhibit substantial growth over the next decade. The market is expected to reach 3.5 USD Billion by 2024, with a forecasted increase to 7.2 USD Billion by 2035. This growth trajectory indicates a CAGR of 6.78% from 2025 to 2035, reflecting the increasing demand for advanced targeting solutions across various military applications.

Rising Asymmetric Warfare

The rise of asymmetric warfare is influencing the Global FLIR and Laser Designator Targeting Pods Market Industry significantly. Non-state actors and insurgent groups often employ unconventional tactics, necessitating advanced targeting capabilities for effective countermeasures. Military forces are increasingly deploying FLIR and laser designator systems to enhance situational awareness and precision strikes in complex environments. This trend is evident in conflict zones where rapid response and accurate targeting are paramount. As a result, the market is expected to see substantial growth, potentially reaching 7.2 USD Billion by 2035, as armed forces adapt to evolving threats.

Increasing Defense Budgets

The Global FLIR and Laser Designator Targeting Pods Market Industry is experiencing growth driven by increasing defense budgets across various nations. Countries are prioritizing advanced military technologies to enhance operational capabilities. For instance, the United States has allocated substantial funding for modernization programs, which includes investments in targeting pods. This trend is mirrored in nations such as India and Australia, where defense expenditures are projected to rise significantly. As a result, the market is expected to reach 3.5 USD Billion in 2024, reflecting a robust demand for sophisticated targeting systems.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global FLIR and Laser Designator Targeting Pods Market Industry. Innovations in sensor technology, data processing, and integration capabilities enhance the effectiveness of targeting pods. For example, the incorporation of artificial intelligence and machine learning algorithms improves target recognition and tracking accuracy. These advancements not only increase operational efficiency but also reduce the risk of collateral damage. As military forces worldwide seek to leverage cutting-edge technologies, the market is projected to grow at a CAGR of 6.78% from 2025 to 2035, indicating a sustained demand for advanced targeting solutions.

Growing Demand for ISR Capabilities

The demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities is a key driver of the Global FLIR and Laser Designator Targeting Pods Market Industry. Military operations increasingly rely on real-time data for informed decision-making. FLIR and laser designator targeting pods provide critical ISR functionalities, enabling forces to gather actionable intelligence in diverse operational theaters. The integration of these systems into unmanned aerial vehicles (UAVs) further enhances their utility. As nations invest in enhancing their ISR capabilities, the market is poised for growth, reflecting the strategic importance of accurate targeting in modern warfare.

Emerging Markets and Global Partnerships

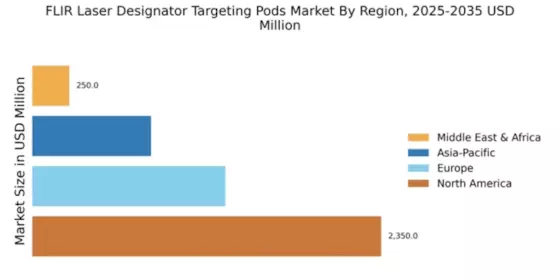

Emerging markets and global partnerships are shaping the Global FLIR and Laser Designator Targeting Pods Market Industry. Countries in Asia-Pacific and the Middle East are expanding their defense capabilities through collaborations with established defense manufacturers. These partnerships facilitate technology transfer and local production of advanced targeting systems. For instance, nations like Saudi Arabia and Indonesia are investing in indigenous defense projects, which include FLIR and laser designator systems. This trend not only boosts local economies but also contributes to the overall growth of the market, as these nations seek to enhance their military readiness.