Market Growth Projections

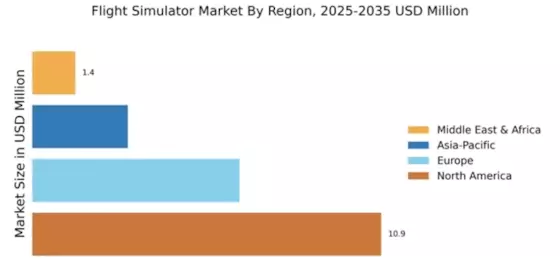

The Global Flight Simulator Industry is poised for substantial growth, with projections indicating a market value of 6.57 USD Billion in 2024 and an anticipated increase to 13.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.89% from 2025 to 2035. Such figures highlight the increasing reliance on flight simulators across various sectors, including commercial aviation, military, and training institutions. The consistent demand for innovative training solutions and the integration of advanced technologies are likely to drive this growth, positioning the industry for a robust future.

Technological Advancements

The Global Flight Simulator Industry is experiencing a surge driven by rapid technological advancements. Innovations in virtual reality and augmented reality are enhancing the realism of flight simulations, making them more immersive and engaging. For instance, the integration of high-definition graphics and real-time weather systems allows users to experience flight scenarios that closely mimic real-life conditions. This trend is expected to contribute to the market's growth, with projections indicating a market value of 6.57 USD Billion in 2024. As technology continues to evolve, the demand for sophisticated flight simulators is likely to increase, further propelling the industry forward.

Growing Demand for Pilot Training

The increasing need for pilot training is a significant driver in the Global Flight Simulator Industry. With the aviation sector expanding, airlines and training institutions are investing heavily in flight simulation technology to ensure pilots receive comprehensive training. Flight simulators provide a safe and controlled environment for pilots to practice various scenarios, including emergency situations. This trend is reflected in the projected market growth, with an anticipated value of 13.7 USD Billion by 2035. The emphasis on safety and efficiency in pilot training is likely to sustain the demand for advanced flight simulators, thereby fostering industry expansion.

Rising Adoption in Military Applications

The Global Flight Simulator Industry is also witnessing increased adoption in military applications. Armed forces worldwide are utilizing flight simulators for training purposes, allowing pilots to hone their skills without the risks associated with actual flight. These simulators are equipped with advanced features that replicate combat scenarios, enhancing the training experience. The military sector's investment in simulation technology is expected to contribute to the industry's growth, with a projected CAGR of 6.89% from 2025 to 2035. This focus on realistic training solutions is likely to bolster the demand for flight simulators in military applications.

Expansion of the Commercial Aviation Sector

The expansion of the commercial aviation sector is a pivotal driver for the Global Flight Simulator Industry. As air travel demand continues to rise globally, airlines are compelled to enhance their training programs to accommodate the growing number of pilots needed. This expansion is reflected in the projected market value of 6.57 USD Billion in 2024, with expectations of reaching 13.7 USD Billion by 2035. The increasing number of aircraft deliveries and the establishment of new airlines contribute to this trend, necessitating advanced flight simulation solutions to ensure pilots are adequately trained. This dynamic environment is likely to sustain the industry's growth trajectory.

Increased Focus on Cost-Effective Training Solutions

Cost-effectiveness is becoming a crucial factor in the Global Flight Simulator Industry. As airlines and training organizations seek to minimize operational costs, flight simulators offer a viable solution by reducing the need for expensive aircraft usage during training. Simulators allow for repeated practice of complex maneuvers without incurring the costs associated with fuel and maintenance. This shift towards cost-effective training solutions is likely to drive market growth, as organizations recognize the long-term financial benefits of investing in flight simulation technology. The trend aligns with the overall expansion of the industry, further solidifying its relevance in aviation training.